Fundamental analysis of XAU/USD

Gold prices rose, recovering from their lowest levels since late June, amid rising expectations of the minutes of the US Federal Reserve's monetary policy meeting. This rally in gold prices was supported by the emergence of cautious optimism in the market. The main contributing factors are expectations of further stimulus packages from China and the likelihood that the Fed will end the tightening cycle based on recent conflicting US data indicators. In addition, the recent passivity of major central banks appears to signal the end of the rate hike cycle. These moves have created a safety net for XAU/USD, especially given China's willingness to continue stimulus and India's economic measures. Despite this, the day before, gold prices were dragged to multi-day lows by strong US retail sales, data from China and US Treasury yields. The XAU/USD pair is also under pressure due to weakness in risk assets such as stocks, bonds and other commodities.

Minneapolis FRB President Neel Kashkari noted that while progress has been made in reducing inflation, it is still too high, hinting at the possibility of delaying new Fed action pending more important data, especially with core inflation holding around 4%. Kashkari's statement also warned, urging caution to avoid the mistakes of the Fed's monetary policy of the 1970s.

Finally, the minutes of last month's FOMC meeting will soon be released, giving market participants a better understanding of the Fed's deliberative process. On a related note, the Federal Reserve Bank of Atlanta released its latest GDP growth forecast of 5%. US industrial production data for July as well as the minutes of the upcoming Federal Open Market Committee (FOMC) monetary policy meeting will play an important role in shaping the trajectory. Notably, any signals from the US central bank hinting at further rate hikes are likely to push XAU/USD below 1900.00.

Technical Analysis and Scenarios:

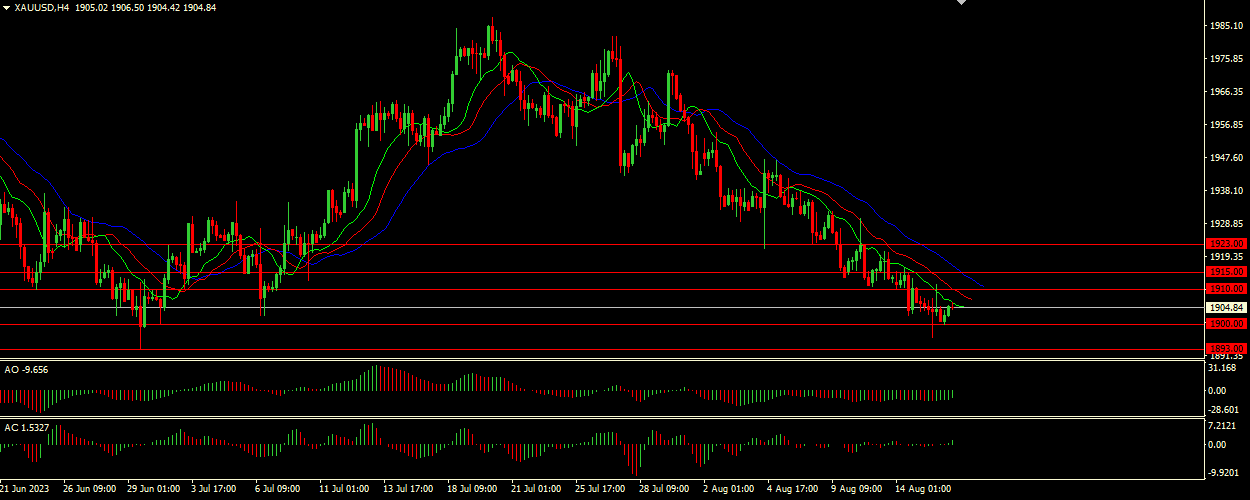

Alligator hunger indicates a downtrend, with the blue line (jaw) well above the green (lips) and red (teeth) lines. This tends to indicate bearish momentum. Awesome Oscillator (AO) and Accelerator Oscillator (AC): Both oscillators are in the green zone, giving a buy signal. This is a bullish sign, indicating a possible trend change or short-term upward movement.

Main scenario (BUY)

Recommended entry level: 1910.00.

Take Profit: 1915.00.

Stop-loss: 1907.00.

Alternative scenario (SELL)

Recommended entry level: 1900.00.

Take Profit: 1983.00.

Stop loss: 1907.00.