Fundamental analysis of USD/JPY

The USD/JPY pair is correcting after a slight decline and is trading at 143.340 as Japanese authorities took steps to defend the currency. This reaction is the result of cautious optimism in the markets and a weaker US dollar amid upcoming US economic data and changes in the dynamics of bond yields.

The Bank of Japan expanded the ceiling on the allowed rate on 10-year Japanese government bonds from 0.5% to 1.0%. The move pushed JGB yields to their highest levels in a decade, and to control the volatility of the Japanese yen, the BOJ announced unscheduled purchases of 5- and 10-year bonds. Japanese Governor Hirokazu Matsuno expressed confidence in the BOJ's strategy and remained vigilant against currency fluctuations.

In the U.S. market, the dollar index declined from a three-week high as the market calmed down after volatility and traded at 102.800. The dollar may be supported by factors such as high US Treasury bond yields and strong US employment data from ADP for July. The figures came in well above market expectations at 324k, while the previous reading was adjusted to 455k, adding strength to the dollar. In the US, where the service sector accounts for more than 70% of the economy, the expected decline in the ISM non-manufacturing PMI from 53.9 to 53.0 could raise recession fears. This indicator, along with other signs of service sector weakness such as layoffs, falling new orders and producer prices, could play an important role in USD/JPY trading psychology. After Fitch downgraded the US government's credit rating from AAA to AA+, there were fears of a possible US default. In response, U.S. Treasury Secretary Janet Yellen and White House economic adviser Jared Bernstein defended the integrity of the U.S. Treasury Department and demonstrated the economic strength of the United States. The Japanese yen's safe haven status remains intact and demand for the yen has increased in the face of economic or geopolitical tensions. China's economic performance and lack of significant stimulus measures have raised recession fears, further increasing the yen's appeal.

Investors are currently watching various economic indicators such as the US ISM Services PMI, factory orders, weekly initial jobless claims, quarterly non-farm productivity and unit labor costs. In addition, the release of PMI data from Japan and China will have a significant impact. Ultimately, the market reaction to the BOJ's hawkish move is likely to have a greater impact on the USD/JPY exchange rate, with concerns likely to limit buyers unless backed up by data. The interplay of many of these factors continues to drive USD/JPY pair dynamics, highlighting the complex nature of international currency relationships.

Technical analysis and scenarios:

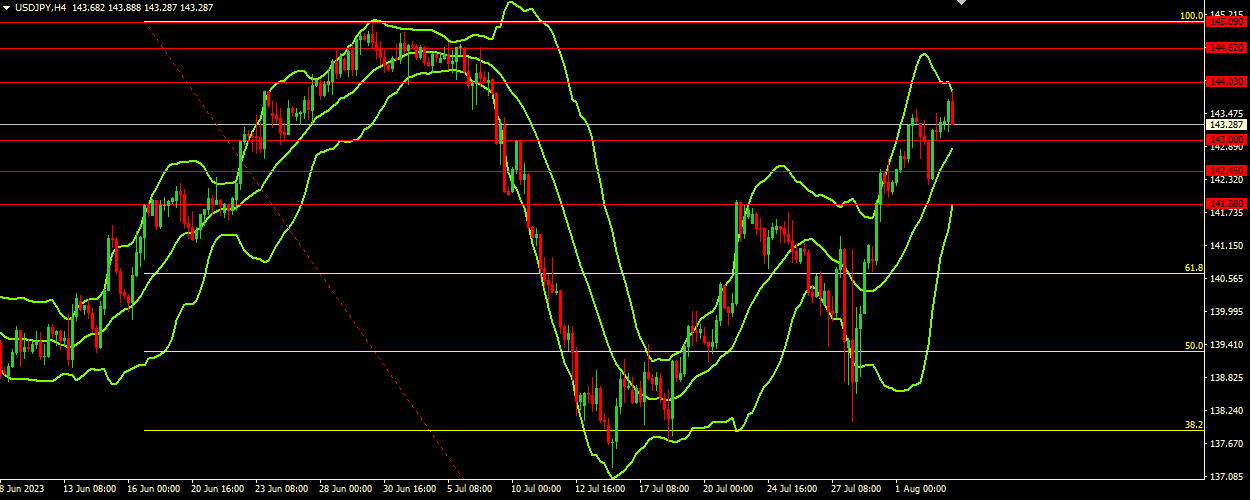

The Bollinger Bands indicate a narrowing price range, with price declining in the upper range, suggesting the possibility of near-term volatility. As the indicator is pointing upwards, a bullish trend may be more likely, but the position in the upper range and proximity to resistance levels may warrant caution. Key support and resistance levels delineate clear boundaries for potential bullish or bearish trends. A breakout above resistance levels could indicate a strong upward move, while a breakout below support levels could indicate a downward trend reversal.

Main scenario (BUY)

Recommended entry level: 144.030.

Take Profit: 144.620.

Stop Loss: 143.700.

Alternative scenario (SELL)

Recommended entry level: 143.000.

Take Profit: 142.450.

Stop loss: 143.200.