Fundamental analysis of WTI

Benchmark US crude oil WTI - currently trading around 86.70. The recent strengthening of prices is due to a number of factors, both domestic and global.

According to preliminary data from the American Petroleum Institute, U.S. oil inventories declined by 5.5 million barrels in the week ending September 1. This figure indicates supply constraints. Globally, major oil producers Saudi Arabia and Russia played a key role in influencing the trajectory of WTI. Both countries have decided to extend voluntary oil supply cuts until the end of 2023. Saudi Arabia is expected to cut production by 1 million bpd in the last quarter of 2023. On the other hand, Russia has pledged to cut production by 300,000 bpd. It is important to note that this reduction will be assessed on a monthly basis depending on changes in market conditions. Under the influence of these factors, oil futures contracts rose. With quotes trading near a nine-month high, market sentiment indicates that a short-term supply cut is imminent.

However, not all indicators are optimistic for WTI. A stronger U.S. dollar could reduce global oil demand, as a stronger dollar makes oil more expensive for holders of other currencies. In addition, as the US Federal Reserve is expected to keep interest rates above 5% for longer, borrowing costs could rise sharply, which could affect the broader economy and, more broadly, oil demand. There are also concerns about the state of the global economy, in particular the slowdown in economic growth in China, the world's largest oil consumer. The latest data showed that the purchasing managers' index in China declined in August, which may be the first sign of a slowdown in oil demand growth in the country.

In addition, a temporary decline in oil demand may be caused by the upcoming September-October refinery maintenance period in the US. Thus, while the short-term outlook for WTI looks optimistic given the lower inventories and reduced international supply, various factors such as a stronger US dollar, potential supply from countries such as Iran, Venezuela and Libya, as well as global economic indicators could limit this uptrend. Therefore, traders should exercise caution in the coming weeks, balancing bullish and bearish signals. Market participants are looking forward to further confirmation from the US Energy Information Administration.

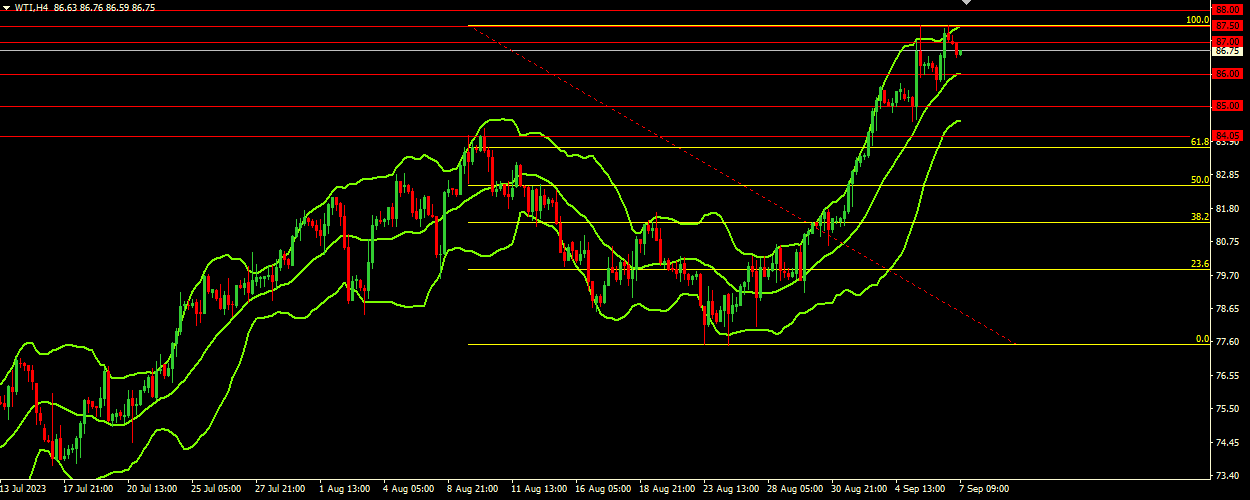

Technical analysis and scenarios:

WTI crude oil is currently trading at 86.70, slightly below the 87.00 resistance level. The Bollinger Bands, a volatility and trend indicator, are pointing in an upward direction with price approaching the upper band, currently at 87.50. This indicates that the market is in a bullish phase. However, if there are signs of reversal, an alternative bearish scenario should always be considered.

Main scenario (BUY)

Recommended entry level: 87.00.

Take Profit: 87.50.

Stop Loss: 86.75.

Alternative scenario (SELL)

Recommended entry level: 86.00.

Take Profit: 85.00.

Stop loss: 86.50.