Fundamental analysis of XAU/USD

Gold is currently in a flurry of volatility, fluctuating under the influence of various macroeconomic indicators and general market sentiment. The gold price is fluctuating around the 1909.80 mark and is sensitive to a number of upcoming global economic indicators and decisions. One of the major factors affecting its price is the outlook for US inflation data, which plays an important role in shaping Federal Reserve policy.

The current price decline is due to the market's growing anticipation of the US Consumer Price Index figures, with some traders strategically exiting the market, perhaps hoping to regain favorable positions after the data is released. If the upcoming inflation index shows a better-than-expected reading, gold could fall below the key threshold of $1,900. However, moderate growth, especially in sectors such as energy, could slow its fall or even allow a rebound. In addition, the strength of the US dollar, fueled by positive economic data and the likelihood of the Federal Reserve maintaining a hawkish stance, continues to cast a shadow over gold's appeal. Market consensus is leaning toward Fed Funds rates remaining at high levels for longer or even rising 25 basis points later this year. In addition, steady inflation, which is not falling as fast as some had expected, means that the Fed may continue to tighten policy.

However, it is not just the United States that is at the center of everyone's attention. The European Central Bank and its upcoming interest rate decision is also important, given Europe's unique economic challenges. A potential shift in European monetary policy, coupled with fluctuations in the euro, could boost demand for gold, reinforcing its reputation as a safe haven.

However, even with these dynamics, a softer risk environment may give gold some respite. Global concerns, such as the deteriorating economic situation in China and the potential impact of rising borrowing costs, are dampening investor enthusiasm for risky portfolios.

Overall, the future of gold appears to be at a crossroads. Public sentiment indicates a bearish outlook. While possible positive developments in US economic indicators may generate short-term optimism, they may also be seen as selling opportunities. The next few days will be crucial as changes in global currencies and data could determine the trajectory of gold. As things stand, the market is on alert, waiting for these important deciding factors to emerge.

Technical analysis and scenarios:

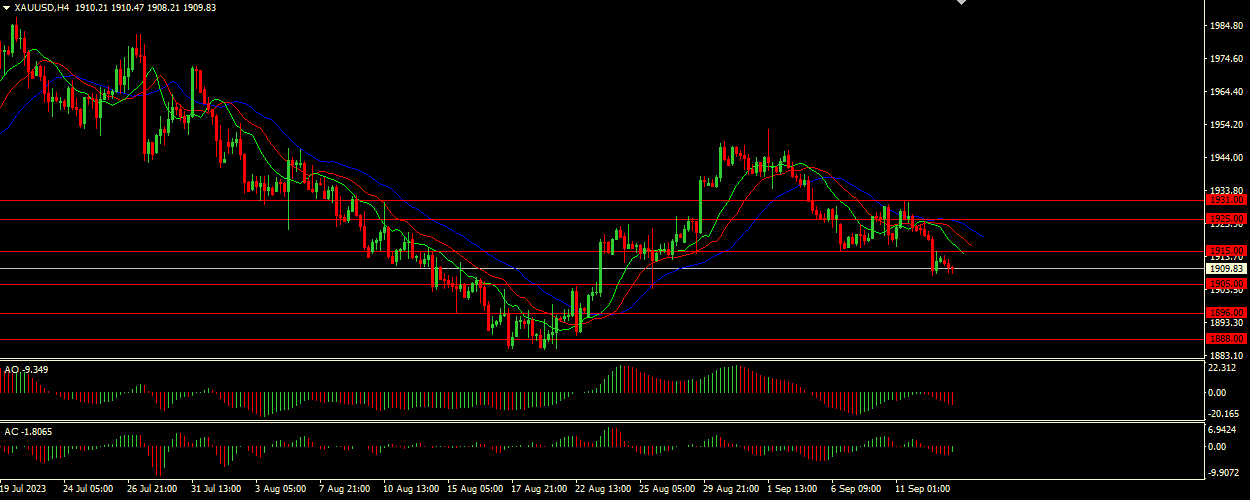

The alligator shows that the alligator is hungry, its mouth is wide open. This indicates a pronounced downtrend as the blue line (jaw) is well above the green and red lines (lips and teeth). The Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the gray area, indicating the presence of divergence. Divergences usually signify potential reversals, but since they are in the gray zone, it is not a reliable signal to start trading. Given the downtrend demonstrated by the Alligator, the price of gold (XAU/USD) may test the nearest support level at 1905.00. If it is broken, we can expect a further decline to the second and third support levels of 1896.00 and 1888.00 respectively.

Main scenario (SELL)

Recommended entry level: 1905.00.

Take Profit: 1896.00.

Stop loss: 1910.00.

Alternative scenario (BUY)

Recommended entry level: 1915.00.

Take profit: 1925.00.

Stop-loss: 1910.00.