General analysis Brent for 08.07.2022

Current Dynamics

A U.S. presidential aide went to Saudi Arabia for preparations for a visit of Biden. Saudi Arabia began selling certain export oil grades with a discount in order to compete with Russian oil. Iraq increased its oil exports in June 2022. The Caspian Pipeline Consortium (CPC) operations were temporarily stopped for 30. China reported an increase in cases of COVID-19 which led to the return of restrictions on the movement of people in 11 cities.White House Middle East Coordinator Brett McGurk went to Saudi Arabia to prepare a visit for U.S. President Joe Biden to the kingdom. It is worth noting that the themes of the visit will be preparations for a summit with the leaders of several countries in the Middle East, and also issues of entrainment of Saudi Arabia's oil production, and normalization of relations between Saudi Arabia and Israel.

Meanwhile, Saudi Arabia began to sell some export grades of oil with a discount in order to compete with the Russian oil. Those are Arab Heavy and Arab Medium grades, which are chemically closer to Urals, than the main Arab Light grade. However, Arab Light prices for August delivery, on the contrary, were increased. It is worth noting that Iran and Venezuela, which are under sanctions, will also dig their heavy oil grades with discount.

Iraq's Oil Ministry reported that Iraq exported in June 2022 oil of 101.191 million barrels or 3.373 million bpd, which is 2.21% more than the daily figures in May. So Iran's oil revenue for the month was $11.505 billion at an average price of $113.7 per barrel.

Meanwhile, the Caspian Pipeline Consortium (CPC) was temporarily stopped for 30 days. This pipeline connected Kazakh fields with Novorossiysk port, from where oil was shipped to tankers bound for Southern Europe and the United States. Last year, the CPC amounted to about 1.2mn bpd. About a third of this volume may be shipped via alternative routes, while the remaining 0.8 mln bpd may temporarily leave the market.

Meanwhile, China has reported an increase in COVID-19 cases, which led to the return of restrictions on the movement of people in 11 cities. In total, these regions together make up about 15% of the Celestial Empire's GDP.

Thus, a possible recession in the U.S. and Europe along with possible lockdowns in China put pressure on oil markets. However, the continuing shortage of heavy oil in the world, combined with the impossibility of quickly increasing oil production support markets. It should be recalled that oil sold from strategic oil sparsity will be delivered to customers until September, which also has some impact on the quotes.

U.S. Baker Hughes Total Rig Count and U.S. Baker Hughes Oil Rig Count will be released today at 19:00 (GMT+2).

Support and resistance levels.

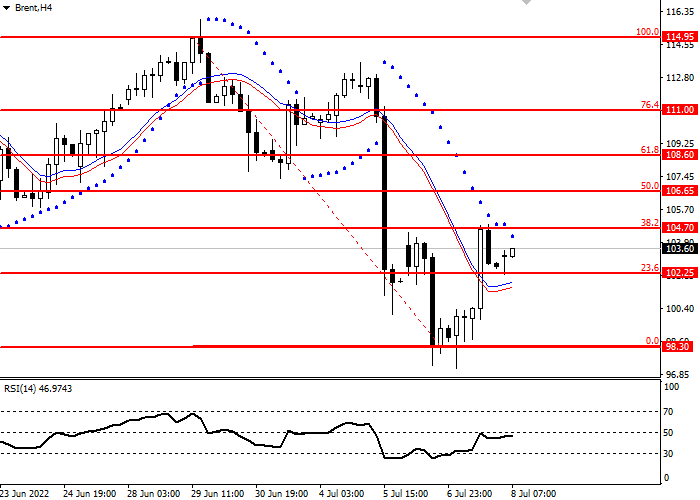

The Brent price broke through the key Fibonacci level of 23.6 and fixed above. The RSI Oscillator has approached the 50 level in the lower zone.- Support levels: 102.25, 98.30

- Resistance levels: 114.95, 111.00, 108.60, 106.65, 104.70

Trading scenarios

- Long positions can be opened above the level of 104.70 with a target of 108.65 and a stop loss of 102.25. Implementation period: 2-4 days

- Short positions can be opened below the level of 102.25 with a target of 98.30 and a stop loss of 104.70. Implementation period: 2-4 days