Fundamental analysis of XAU/USD

After stabilizing around the key level of 1900.00, gold prices rebounded slightly to trade at 1903.50. This shift was driven by a decline in the US Dollar Index from a two-month high and a temporary slowdown in US Treasury yields, which recently hit a 16-year high. This allowed for some recovery to take place.

One of the key events of the week that caught the attention of market watchers was a symposium in Jackson Hole, Wyoming. Expectations are high ahead of Fed Chair Powell's next speech and markets are eager to learn the Fed's views on interest rate changes. Of particular note is the Fed's view on the 2% inflation index in the context that core inflation remains high. Some have suggested that any tendency for this target to correct could lead to interest rates staying in line with current values.

FRB Richmond President Thomas Birkin recently added interest by suggesting that the Fed should remain open to the possibility that the U.S. economy could accelerate. This, in turn, could affect the country's inflation strategy. This assessment is supported by strong economic signals from the US, which point to the possibility of further interest rate hikes. Nevertheless, the attractiveness of gold for investors seems to be declining. This is evidenced by the declining share of gold in ETFs.

Another interesting aspect is the relationship between the weakness of XAU/USD and the US dollar, the decline in bond yields and the cautiously upbeat market outlook. The prospect of warming relations between the US and China and discussions on de-dollarization at the BRICS summit in South Africa may tip the scales in gold's favor. Meanwhile, market speculation based on interest rate futures indicates that the Fed will not change rates next month and Powell's speech at Jackson Hole may not have a warm tone.

For now, however, markets are eagerly awaiting the August purchasing managers' index results for the world's major economies, on the back of recent strong economic data in the US and the Fed's refusal to force rate cuts. Forced rate cuts are keeping the XAU/USD rate low. The complex interplay of these factors seems to cautiously reduce the future attractiveness of gold.

Technical analysis and scenarios:

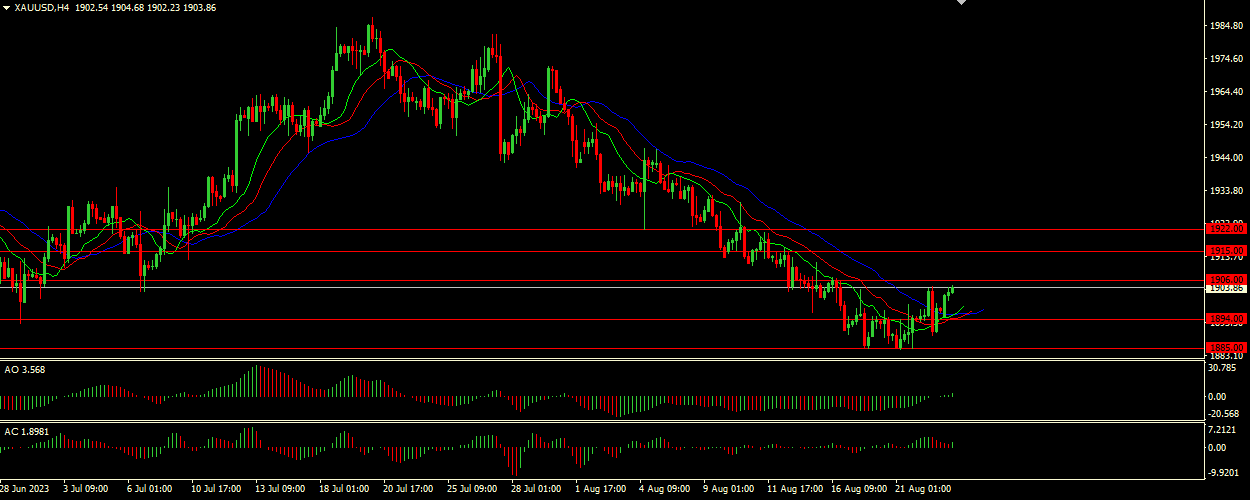

The alligator opens its jaws, with the jaw (blue line) positioned below the lips and teeth (green and red lines). This indicates that the instrument is likely at the beginning of an uptrend. Awesome Oscillator (AO) and Accelerator Oscillator (AC): Both oscillators are in the green zone. The bars are close to the zero level, indicating a solid buy confirmation. Given the current technical indicators, a bullish scenario is most likely. Here is the recommended buy strategy.

Main scenario (BUY)

Recommended entry level: 1906.00.

Take Profit: 1915.00.

Stop Loss: 1900.00.

Alternative scenario (SELL)

Recommended entry level: 1894.00.

Take Profit: 1885.00.

Stop-loss: 1900.00.