Fundamental analysis of XAU/USD

Gold prices rose after hitting a 5-week low as traders remained cautious amid somewhat unfavorable market conditions. The slight increase in the cost of the yellow metal is explained by a decline in US Treasury bond yields combined with a weaker US dollar and expectations of an economic stimulus package from China. However, the U.S. bond market is still under pressure, with yields recently hitting multi-year highs. Meanwhile, the U.S. dollar index has been on the rise for the fourth week in a row as investors eagerly await news from the upcoming annual symposium in Jackson Hole, where prominent central bank governors are expected to address the financial community.

In addition, recent developments in China are playing an important role in influencing sentiment in global markets. Evergrande, not only China's second largest brokerage company but also the world's most indebted real estate developer, recently filed for protection from creditors in bankruptcy court. However, speculation about the Chinese government's willingness to take additional stimulus measures to protect the economy from worsening debt problems seems to be offsetting the prevailing pessimism in the market, reducing the pressure on gold prices. In addition, the recent publication of the minutes of the July FOMC meeting had a significant impact on the market, causing US bond yields to rise to their highest levels since 2011. In particular, the yield on 10-year U.S. bonds reached a record low since 2007, while the yield on 30-year Treasuries reached its highest level since April 2011. The long-term outlook is largely based on indications that the Federal Reserve will be inclined to maintain tight monetary policy, including possibly a rate hike soon. The Fed remains firmly committed to containing inflation and bringing it back to the 2% target, and recent strong GDP growth figures suggest a more aggressive stance.

Technical analysis and scenarios:

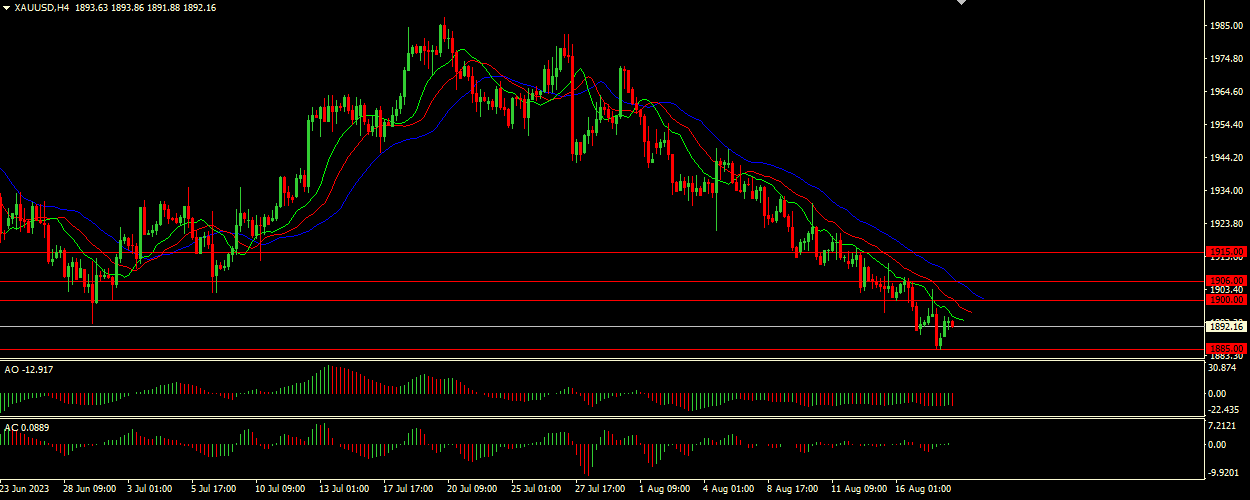

The prevailing trend for XAU/USD looks bearish as indicated by the Alligator with its wide open mouth and jaw well above the teeth and lips, suggesting that the instrument is currently in a downtrend. The current price of XAU/USD is at 1893.00, which is close to the significant psychological resistance level of 1900.00. Given the bearish momentum, there is a possibility that gold prices could test the nearby support levels. As the AO and AC indicators are currently in the gray zone and showing divergence, traders should be cautious as these signals are not reliable enough to rely on them alone. Divergence usually indicates that the current trend is losing strength and a reversal or consolidation period may be imminent.

Main scenario (SELL)

Recommended entry level: 1885.00.

Take Profit: 1880.00.

Stop-loss: 1887.00.

Alternative scenario (BUY)

Recommended entry level: 1900.00.

Take profit: 1906.00.

Stop loss: 1897.00.