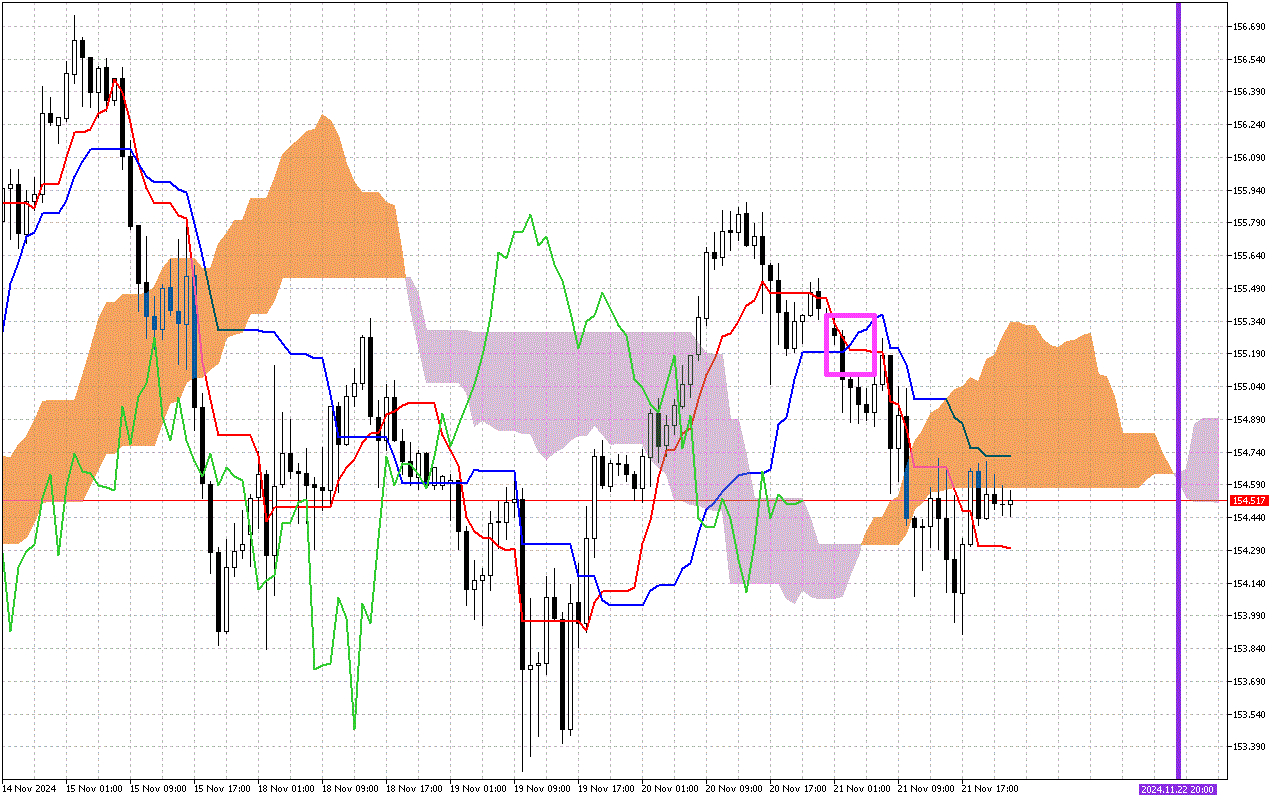

USDJPY H1: The Ichimoku Forecast for the Asian Session on 22.11.2024

The second most important signal is the change in direction of the Kumo cloud, marked with a vertical purple line. A change in the color of the cloud to lilac indicates a transition of the priority direction of movement to downward.

The current situation:

Let's look at the main components of the indicator and their current values:

The price is now positioned between the Tenkan and the Kijun lines, indicating a temporary consolidation before a potential resumption of the trend.

The Kumo cloud is colored lilac. It indicates the priority of the downward vector of price movement.

The price is below the Kumo cloud, which is now acting as a resistance area for the price.

Used by investors to identify a change in trend, the green Chinkou line is above the price on the chart.

Trading recommendations:

The dynamic support level is on the Tenkan line, around the 154.308 mark.

Dynamic resistance levels are located on the Kijun line, near the 154.719, the SenkouA line, at the 155.269 mark, and the SenkouB line, near the 154.579 mark.

The indicator signals support a downward vector of price movement, so the search for the short positions entry points should be prioritized.