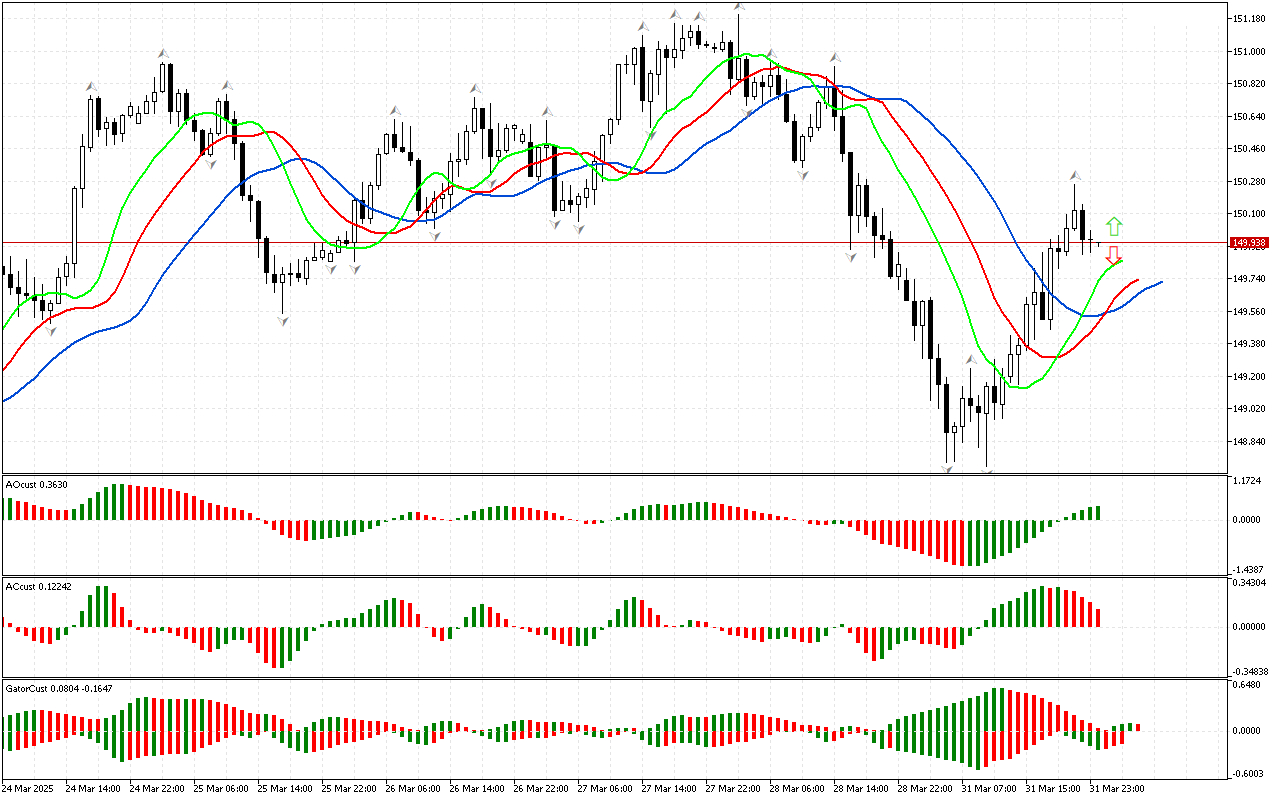

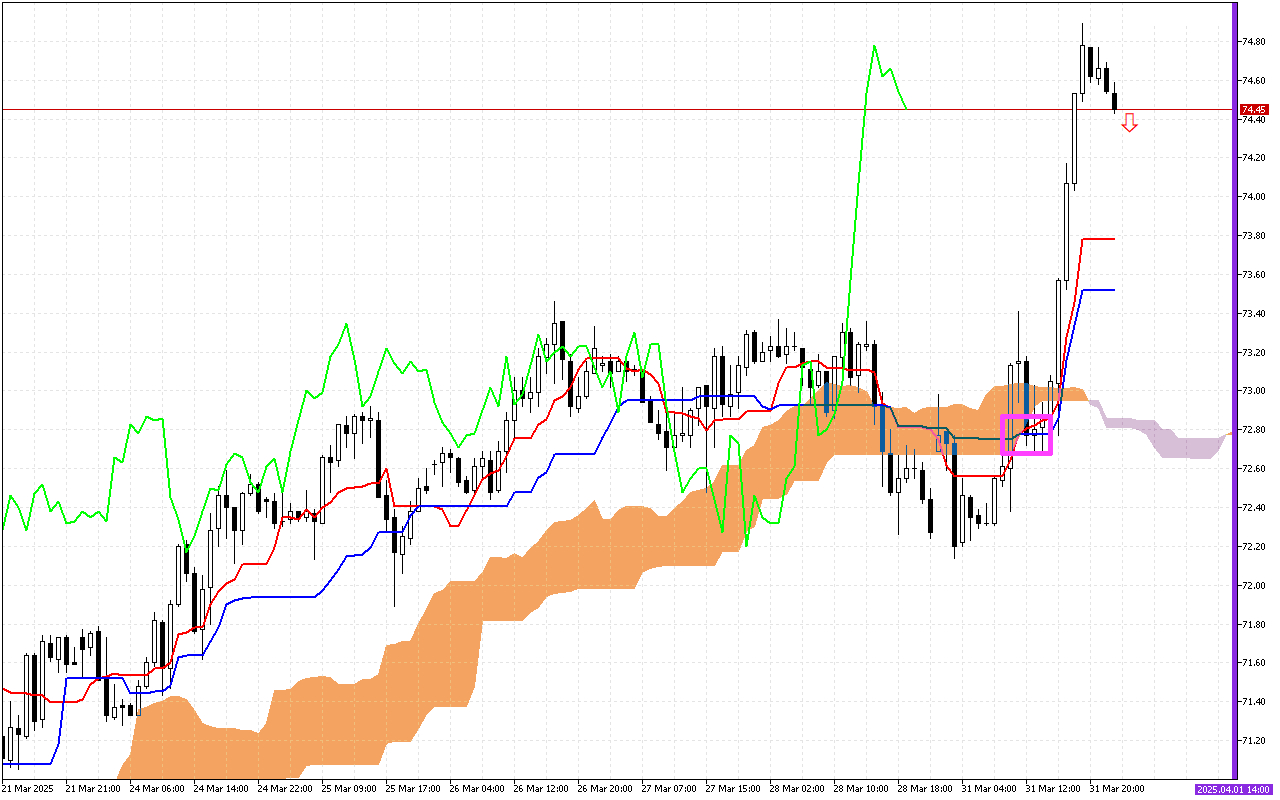

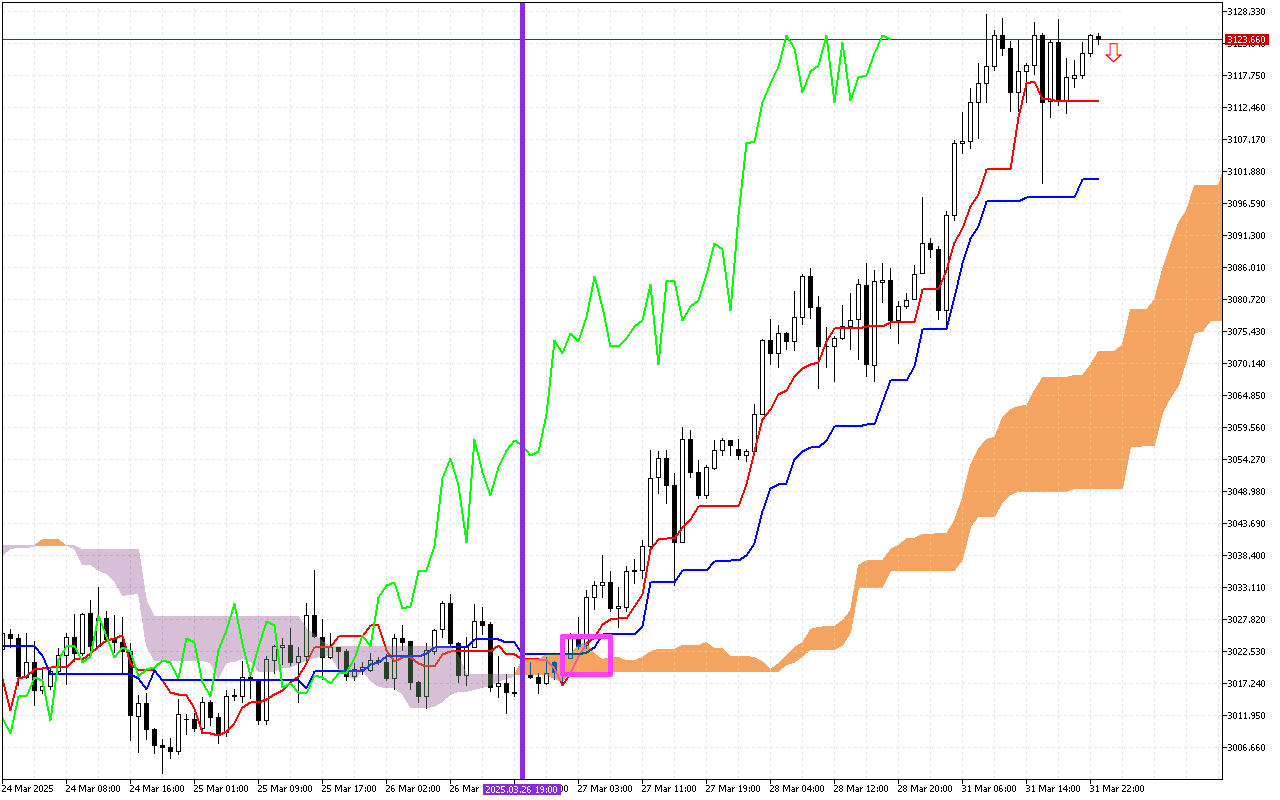

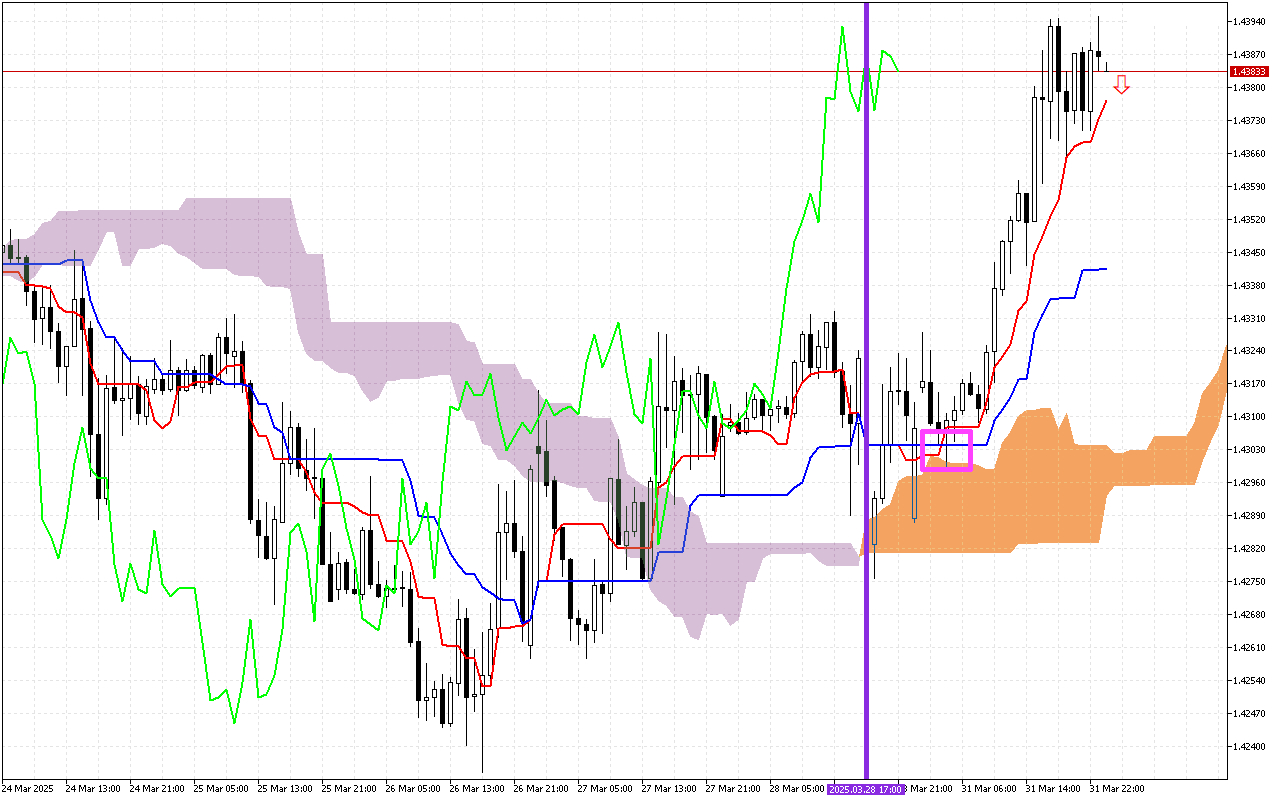

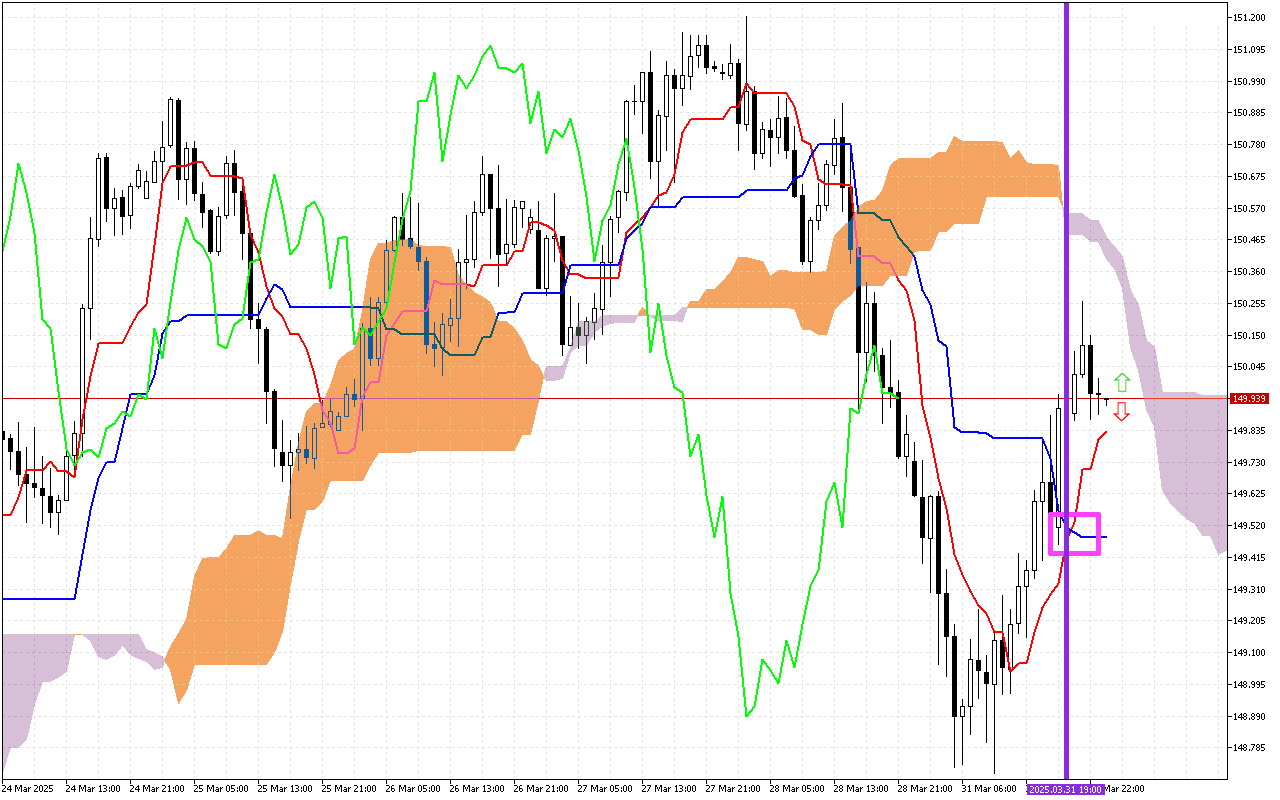

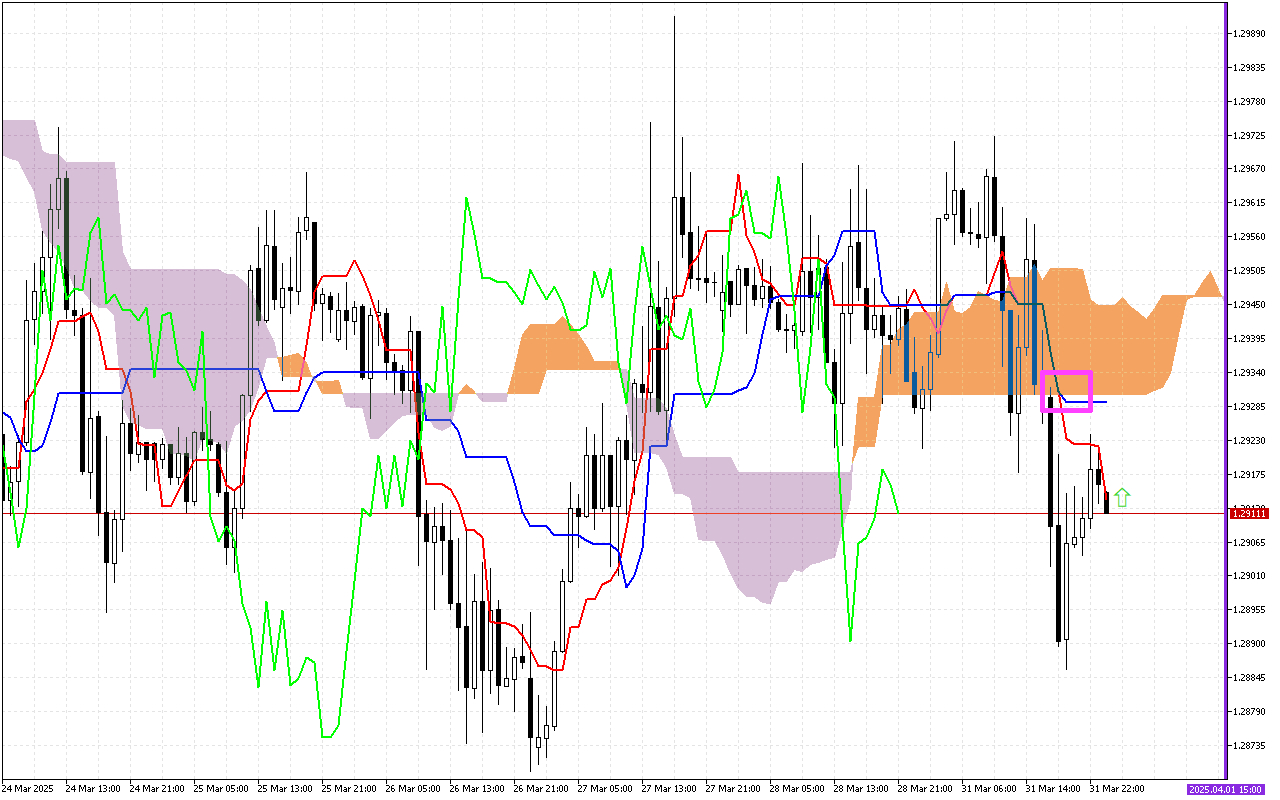

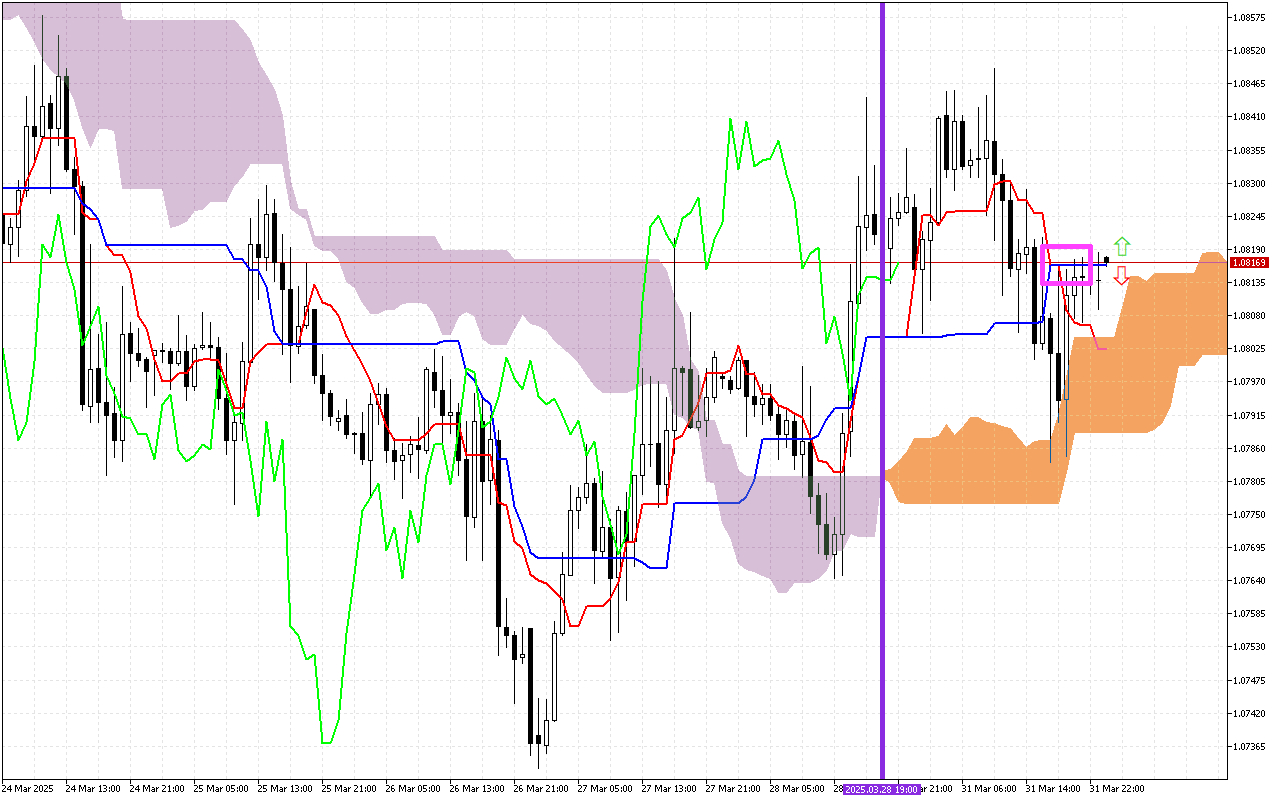

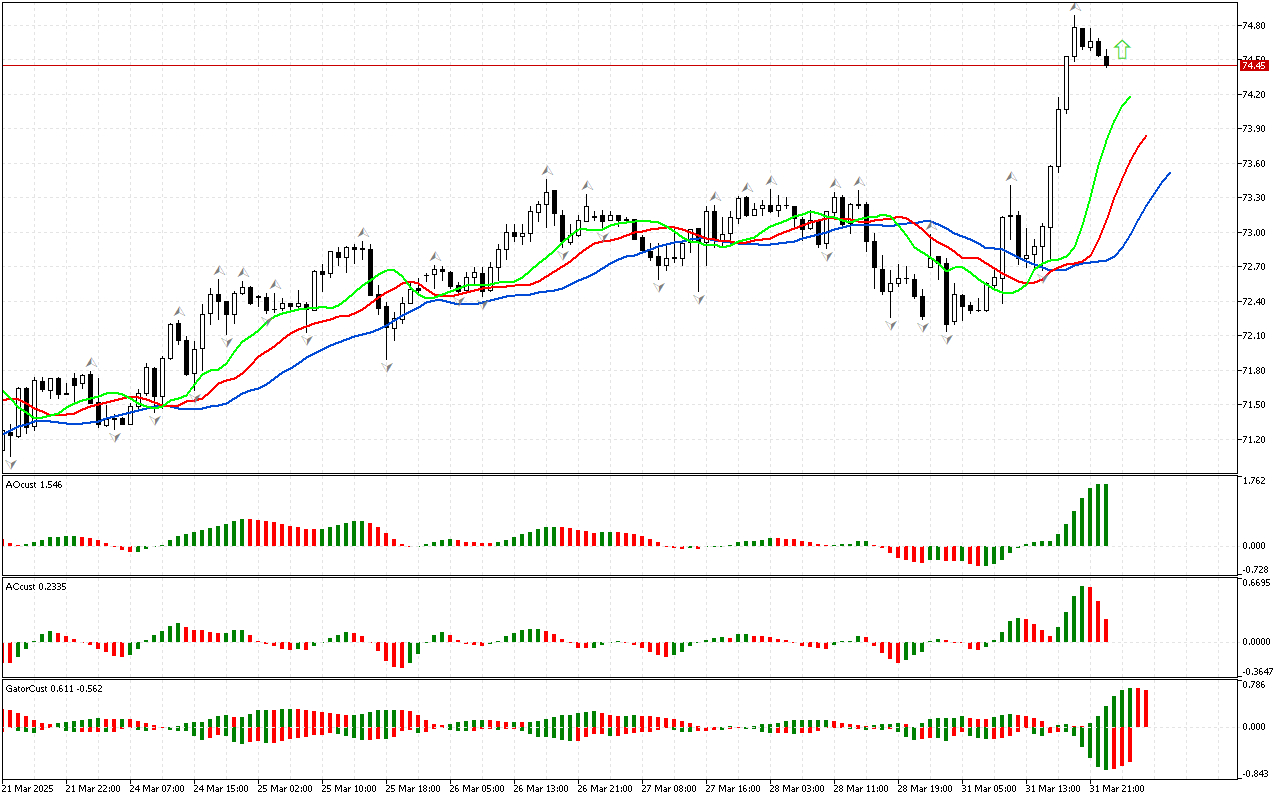

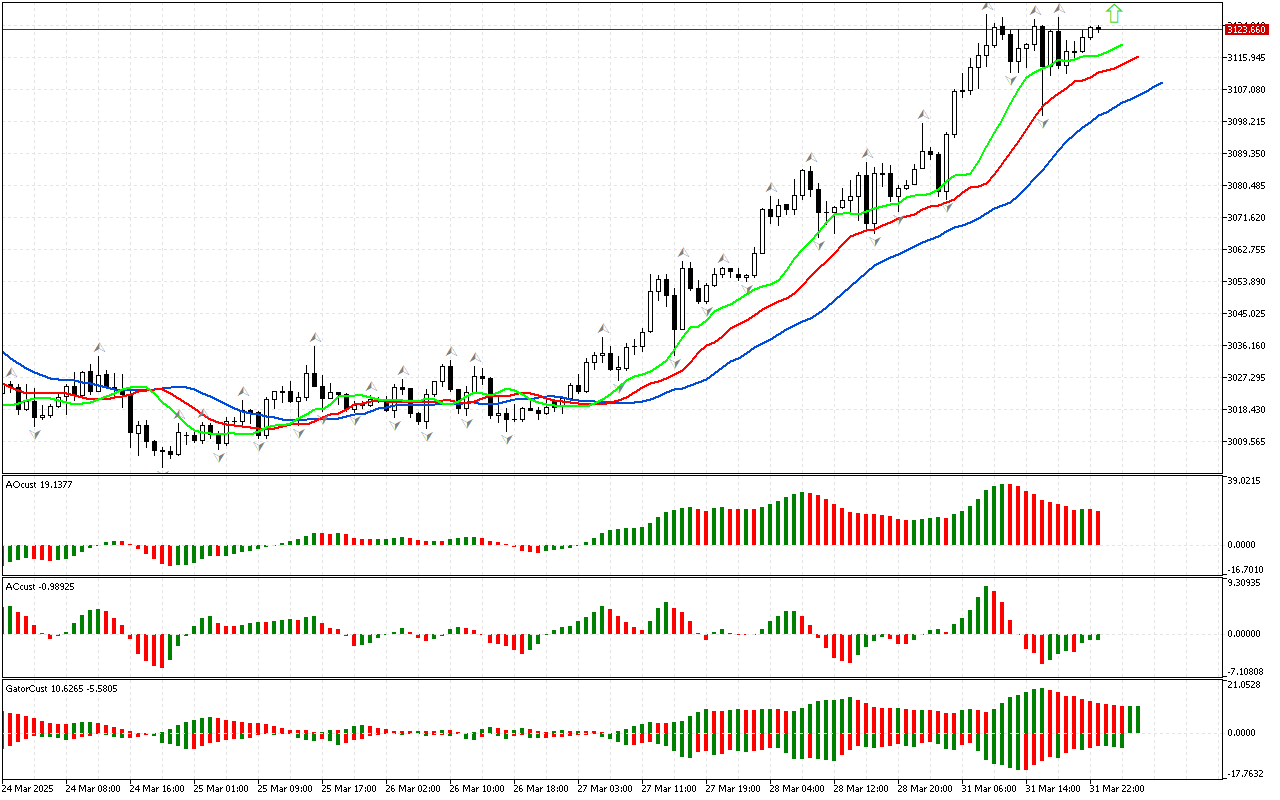

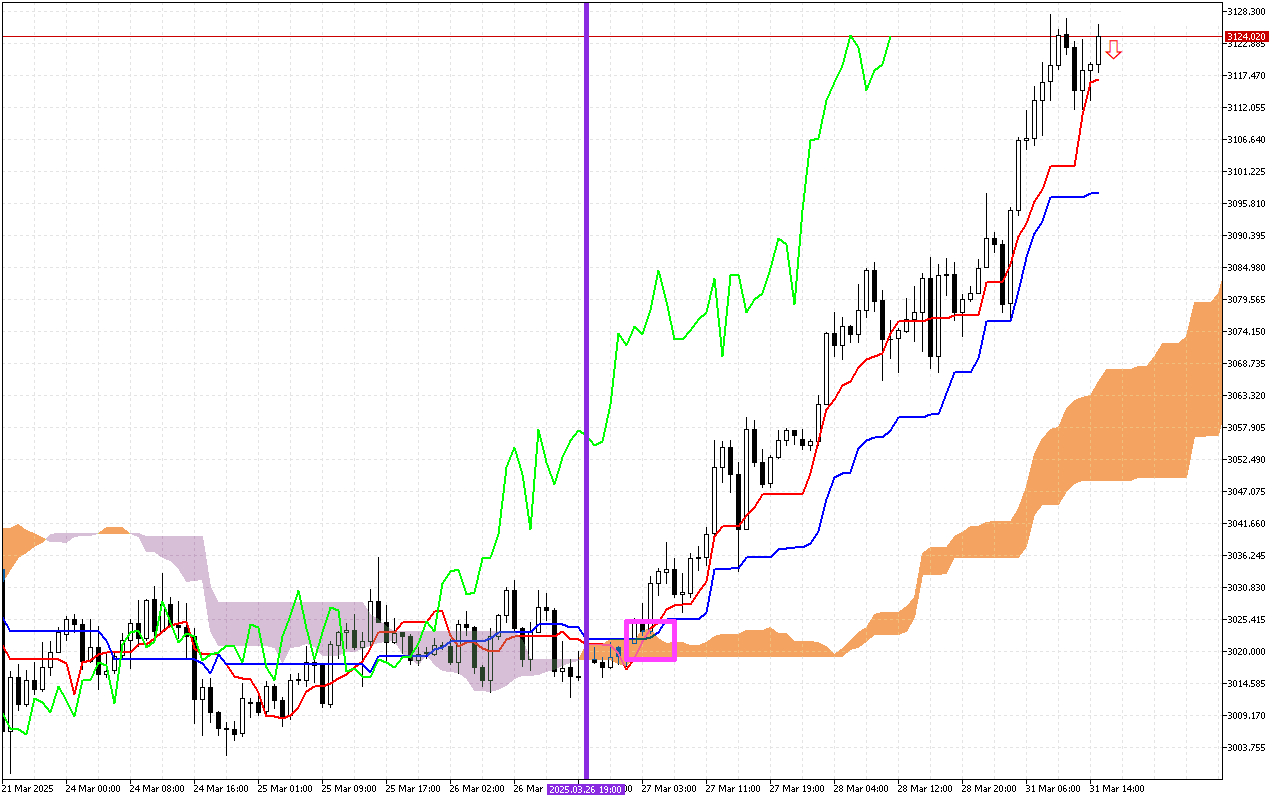

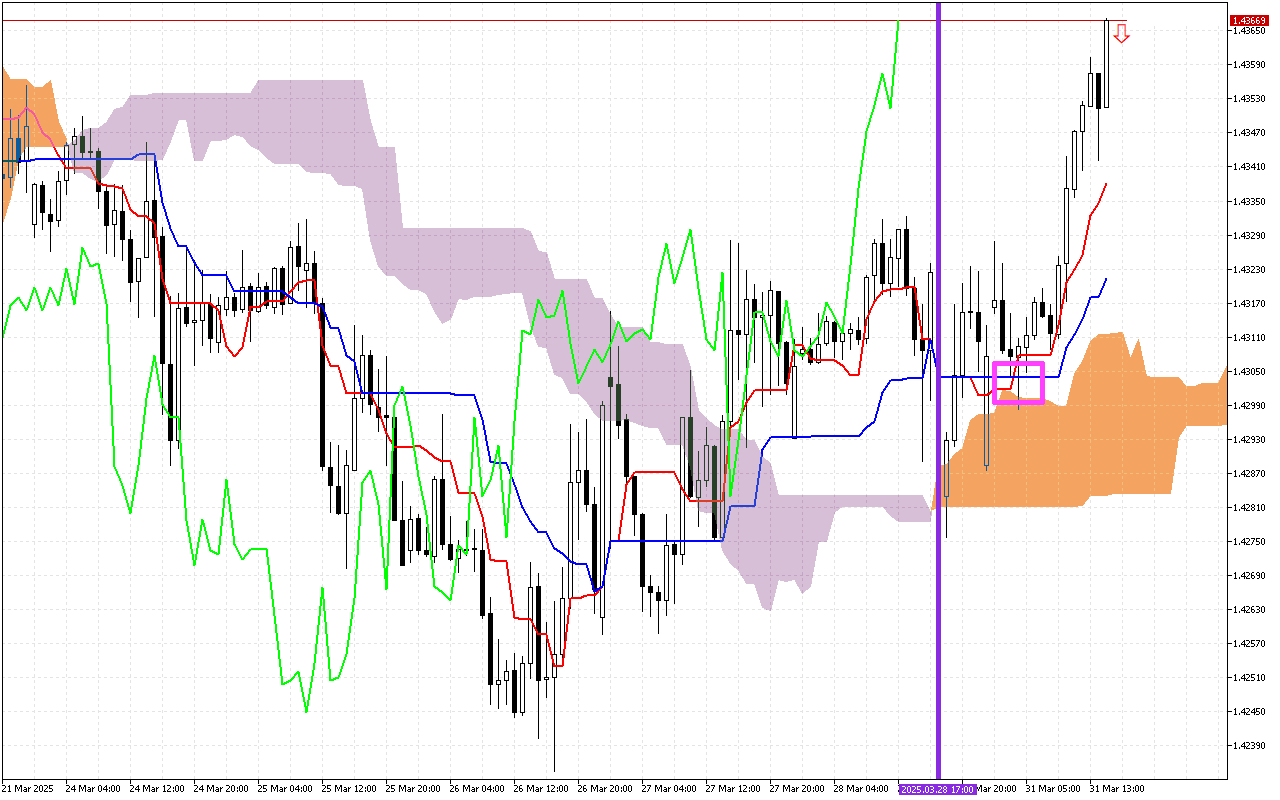

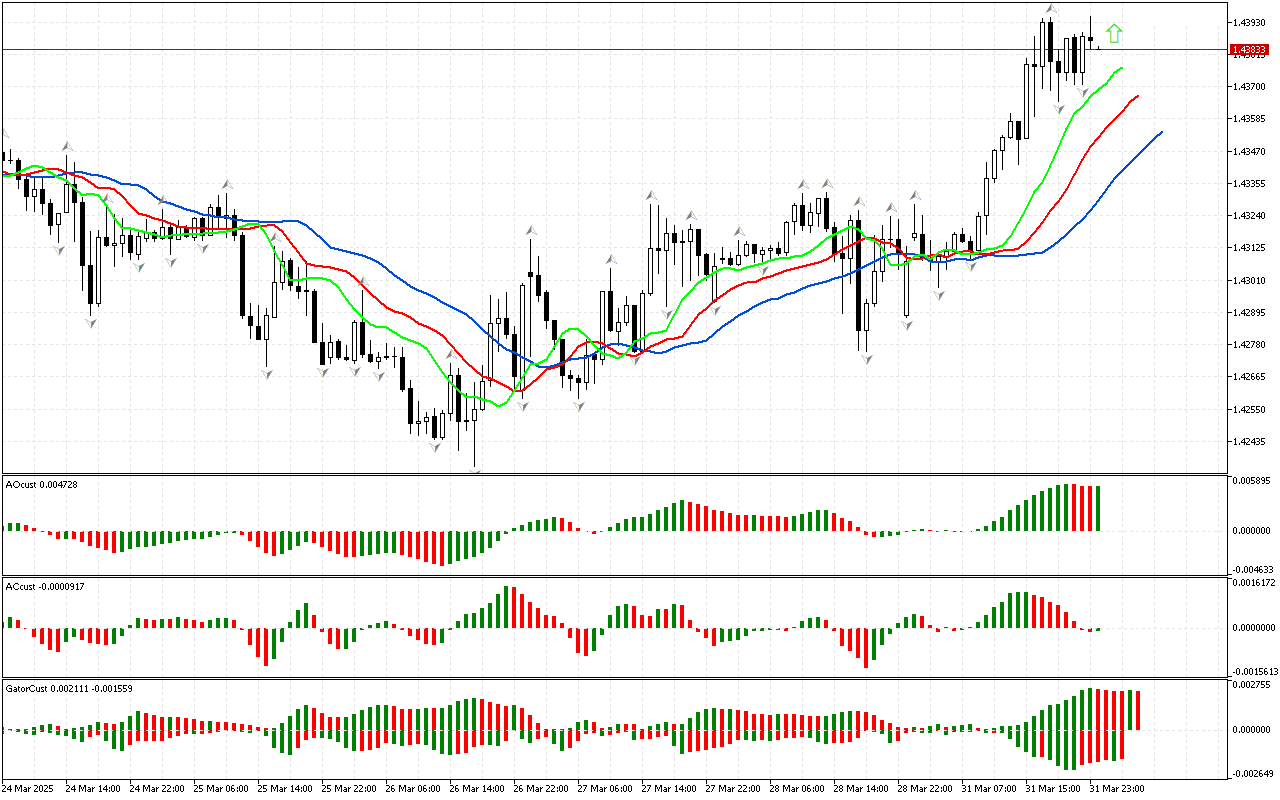

USDCAD H1: The Chaos Theory Forecast for the Asian Session on 1.4.2025

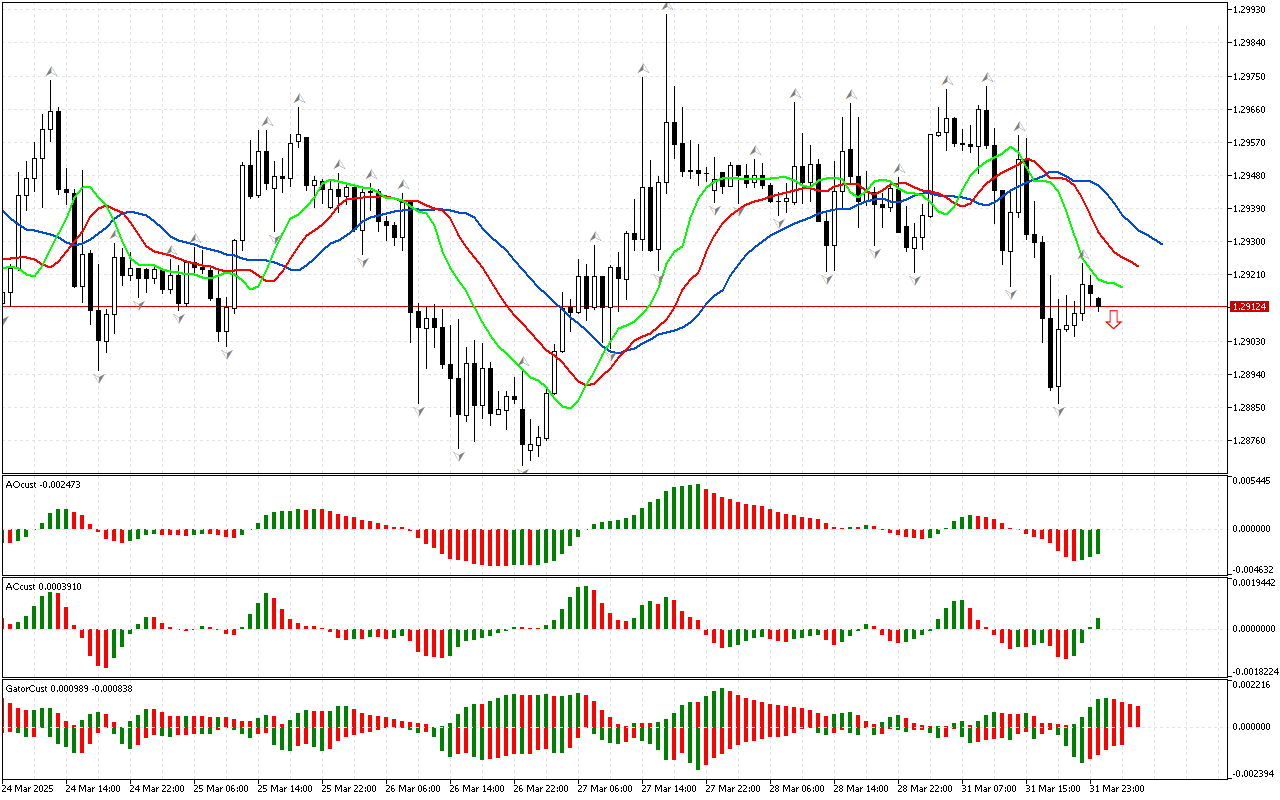

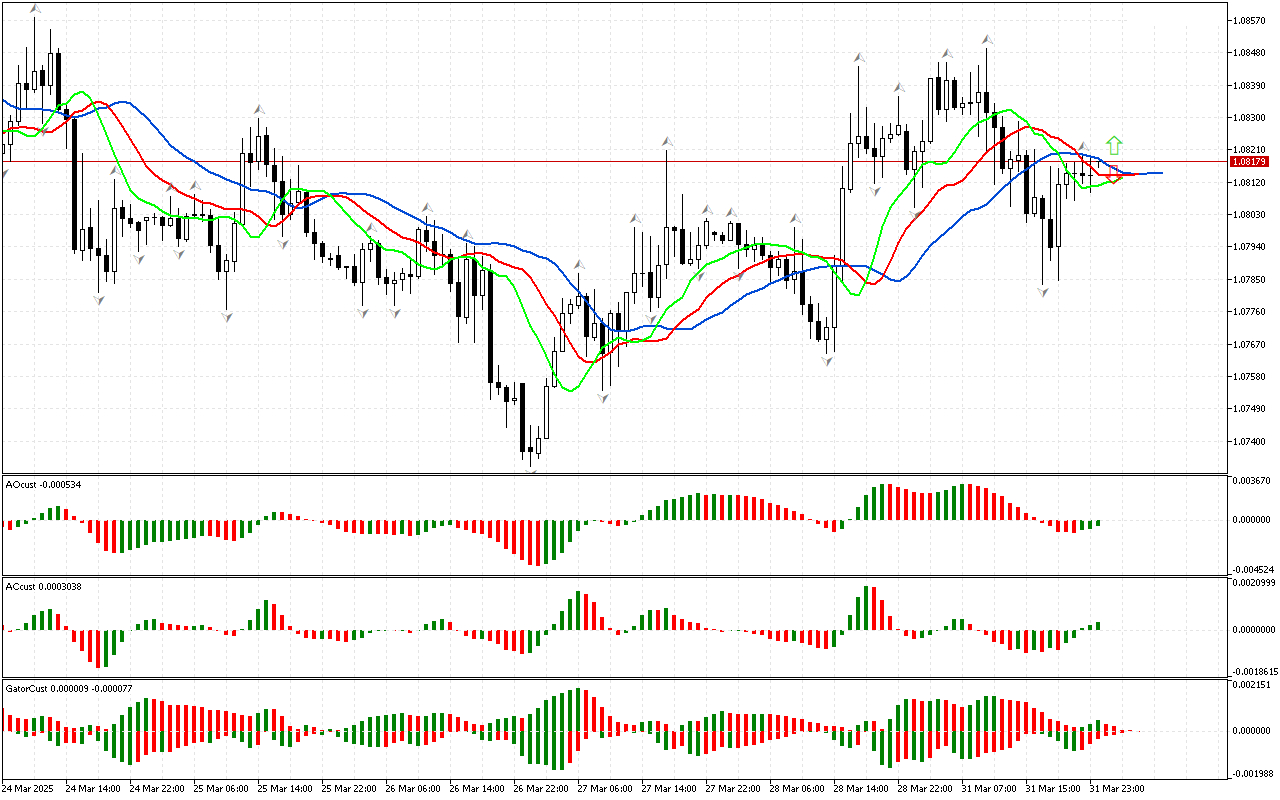

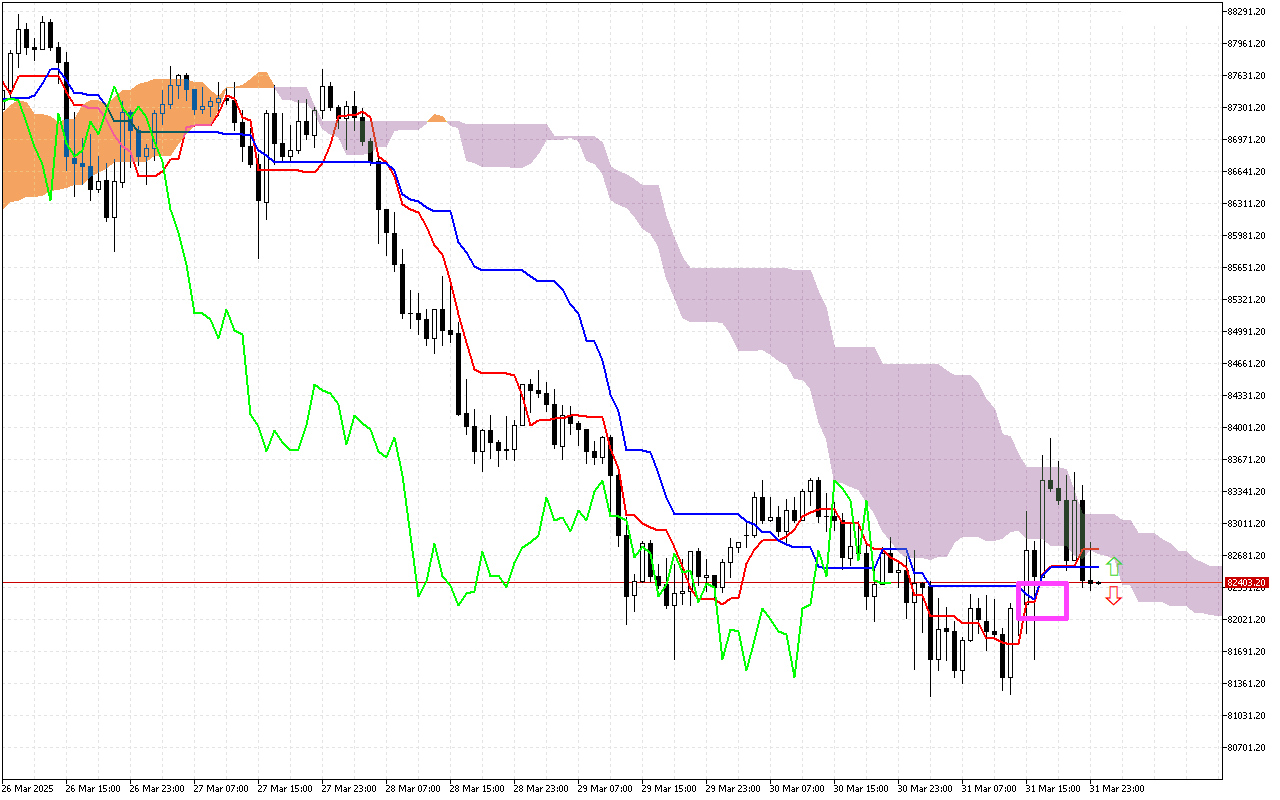

According to USDCAD, the phase space is defined as northern, since the price has risen above the upper fractal. Now we can examine signals from other market dimensions within the...