Fundamental analysis of WTI

US WTI crude oil prices declined on Monday, mainly due to the Fed's stance making oil markets wary, as evidenced by the drop in oil contracts last week after a three-week rise. These changes are mainly due to concerns about oil demand in the face of possible interest rate hikes.

At the same time Russia's decision to temporarily restrict fuel exports, earlier led to a rise in global oil prices, Russia's substantial embargo on gasoline and diesel is designed to stabilize the domestic market. This move by Russia adds to concerns about already tight oil supplies and raises concerns about jet fuel availability, especially ahead of winter. At the same time, recent hawkish signals from the US Federal Reserve have heightened concerns about the possibility of future interest rate hikes.

Meanwhile, a report from Baker Hughes highlighted the trend in the US, where the number of active rigs fell to 507, the lowest level in a year, due to rising oil prices. From a global perspective, China, a major oil importer, plays an important role in shaping market sentiment. According to some forecasts, China's manufacturing industry is expected to rebound this month, and the manufacturing purchasing index is expected to rise. China's growing oil demand, which recently increased by 300,000 barrels per day, is also shaping trends in the global oil market. WTI crude oil prices are forecast to fluctuate between $90 and $100 per barrel, and while oil prices appear likely to rise in the short term, it is predicted that prices could stabilize around 95.00 later this year. However, a continuation of the trend above the 100.00 threshold could lead to an increase in U.S. crude supplies, triggering a bearish trend. According to another observation, the joint supply cuts by Saudi Arabia and Russia totaling 1.3 million barrels per day are likely to last until 2023, leading to a global oil deficit of 2 million barrels per day.

In this situation, the US Dollar Index (DXY) is trying to regain momentum and is hovering around the 105.70 level. However, if the 10-year Treasury bond yield reaches 4.45%, the dollar could strengthen. Federal Reserve officials, including Boston Fed President Susan Collins and Fed Chairwoman Michelle Bowman, urged patience while emphasizing the possibility of further tightening. The Fed has emphasized the importance of keeping interest rates high as it seeks to bring inflation back to its 2% target. This approach has bolstered market expectations for another 25 basis point rate hike before the end of the year.

In the coming days, investors' attention is likely to be focused on the US economic calendar, which includes key data such as consumer confidence, durable goods orders, new jobless claims and core PCE, the Fed's main measure of inflation. The expected annualized decline in core PCE from 4.2% to 3.9% will give an indication of the state of the US economy and provide a benchmark for WTI oil traders. Thus, trends in the oil market depend on a combination of geopolitical decisions, concerns over rising interest rates, major market participants such as China, and other economic indicators, leading to a period of significant volatility.

Technical Analysis and Scenarios:

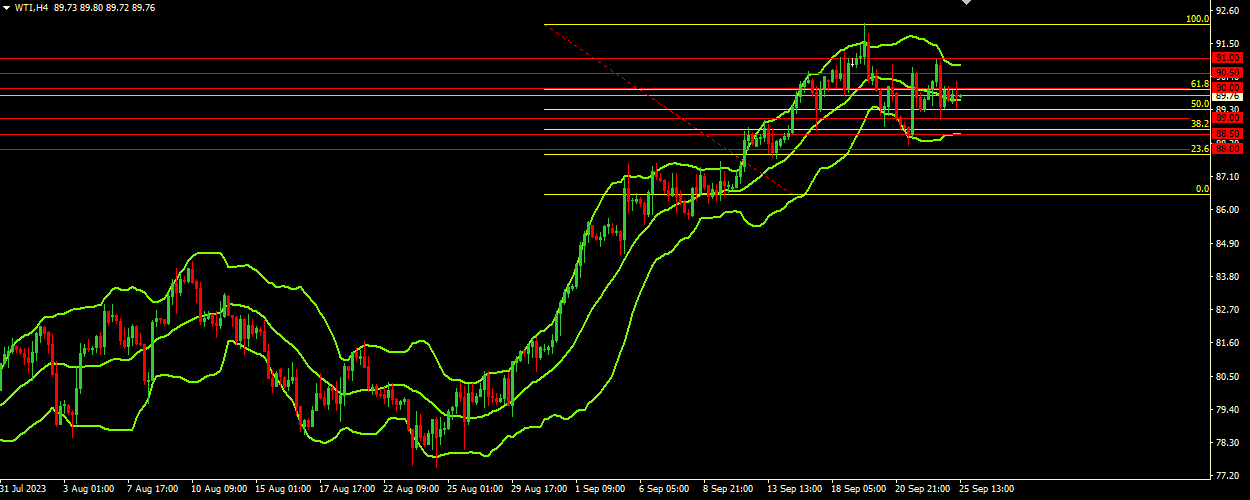

WTI crude oil is currently trading just below the 90.00 mark. Given the price's position relative to the Bollinger Bands, it is trading in the upper range, but is now correcting towards the middle band, which is at 89.65. WTI crude oil is currently at a tipping point, trading near significant technical levels. It is crucial to closely monitor the price movement in the coming days, especially around the middle Bollinger Bands.

Main scenario (BUY)

Recommended entry level: 90.00.

Take Profit: 90.50.

Stop loss: 89.75.

Alternative scenario (SELL)

Recommended entry level: 89.00.

Take Profit: 88.50.

Stop loss: 89.25.