Fundamental analysis Gold for 16.10.2024

Gold prices (XAU/USD) have maintained a positive momentum for the second consecutive day, recently reaching a high of around $2,675. This rally is primarily driven by increased demand for safe-haven assets due to rising geopolitical tensions, particularly in the Middle East, where the conflict between Israel and militant groups like Hezbollah is intensifying. These geopolitical risks have prompted investors to seek safer investments, contributing to gold's upward movement.

The economic backdrop also plays a crucial role in shaping gold’s price trajectory. U.S. Treasury yields have decreased over the past two days, following weaker-than-expected economic data. The Empire State Manufacturing Index recorded a significant drop to -11.9 in October, its lowest since May, signaling a slowdown in the U.S. manufacturing sector. The decline in yields has made non-yielding assets like gold more appealing, further supporting its price.

However, the U.S. dollar remains relatively strong, consolidating after reaching a two-month high. Market participants expect the Federal Reserve to proceed with a cautious approach, potentially enacting a 25 basis point rate cut in November. This measured stance from the Fed limits the potential for a sharp decline in the U.S. dollar, capping further gains for gold.

Additionally, lower oil prices are easing inflationary pressures, contributing to expectations of a moderate pace of interest rate cuts by the Fed. This environment has prevented a significant rally in gold prices, as a stronger dollar and stable policy outlook act as counterweights to the metal’s gains.

Overall, while falling U.S. Treasury yields and ongoing geopolitical uncertainties are driving demand for gold, the cautious monetary policy stance of the Federal Reserve and a resilient U.S. dollar are likely to limit significant upward movement for XAU/USD.

Looking ahead, market focus will turn to upcoming U.S. economic releases, including Monthly Retail Sales, Industrial Production, and Weekly Initial Jobless Claims, as well as key Chinese economic data. These reports are likely to shape near-term market sentiment and influence the direction of both the U.S. dollar and gold prices.

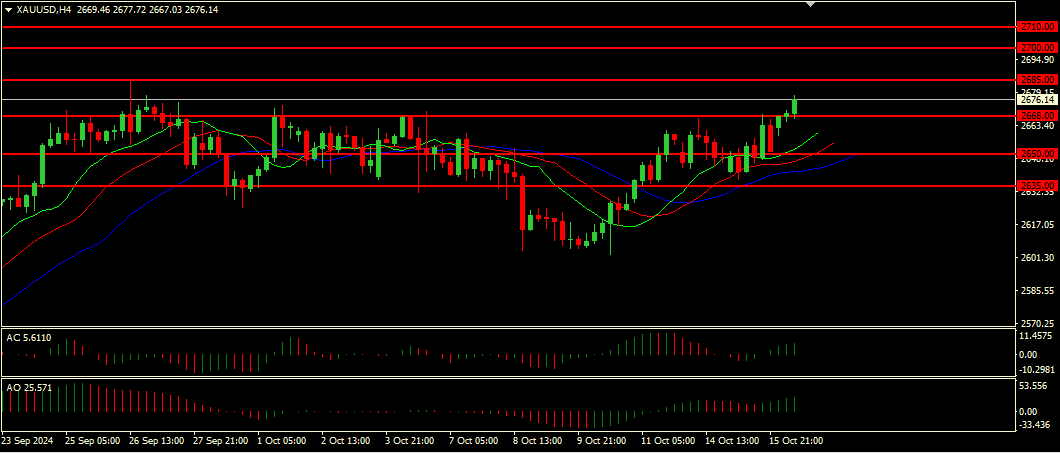

Technical analysis and scenarios:

The Alligator indicator indicates a strong uptrend: the mouth is wide open and the jaw (blue line) is

located below the lips and teeth (green and red lines). The Awesome Oscillator (AO) and

Accelerator Oscillator (AC) are in the green zone, confirming a buy signal.

Main scenario (BUY)

Recommended entry level: 2685.00

Take profit: 2700.00

Stop loss: 2668.00

Alternative scenario (SELL)

Recommended entry level: 2668.00

Take profit: 2650.00

Stop loss: 2685.00