Fundamental analysis of XAU/USD

Gold is going through a volatile period marked by significant fluctuations and economic events that have affected its price and demand. XAU/USD is currently trading at 1949.50 after an upward correction.

One of the main catalysts for the rise in gold prices was the unexpected downgrade of the US credit rating by Fitch Ratings from AAA to AA+. The move was attributed to concerns over the country's slowing financial growth and increasing government debt over the next three years. While the previous downgrade sent the market into turmoil, this time the initial reaction was relatively calm, but experts continue to monitor the situation. U.S. Treasury Secretary Janet Yellen disagreed with the decision, calling it "arbitrary," and this disagreement has raised concerns about the U.S. debt ceiling crisis. The downgrade led to a drop in confidence in the economy, prompting investors to rush to gold, considered a safe-haven asset. This has led to an increase in demand, reflecting gold's historical role as a preferred investment during periods of economic uncertainty and stress.

The deteriorating situation, as well as escalating tensions between the US and China, are putting pressure on the US dollar. Concerns include China's restrictions on exports of drones and related equipment to the U.S., as well as President Joe Biden's planned restrictions on government investment in U.S. technology in China. A weakening dollar could create a headwind for gold prices. Meanwhile, the prospect of further rate hikes by the Federal Reserve, the European Central Bank and the Bank of England are creating problems by limiting gold's upside.

According to the World Gold Council, gold demand in India could fall by 10% in 2023, hitting a three-year low due to record highs. This reduction could affect the entire market, possibly reducing India's trade deficit and supporting the Indian rupee. Annual demand is also forecast to fall by 2%, and fears of slowing economic growth among major gold buyers such as China add to this difficult picture.

Investors adrift in these uncertain waters need to be vigilant. Against the backdrop of ongoing world events, economic indicators and various market reactions, the potential outcomes, or conversely the consequences, in the precious metals market remain at the forefront of traders' minds. The interplay between credit ratings, international relations, interest rates and market sentiment continues to shape the landscape for gold, making it an attractive and multifaceted investment environment. Market participants are currently keeping a close eye on the non-farm payrolls report and weekly jobless claims.

Technical Analysis and Scenarios:

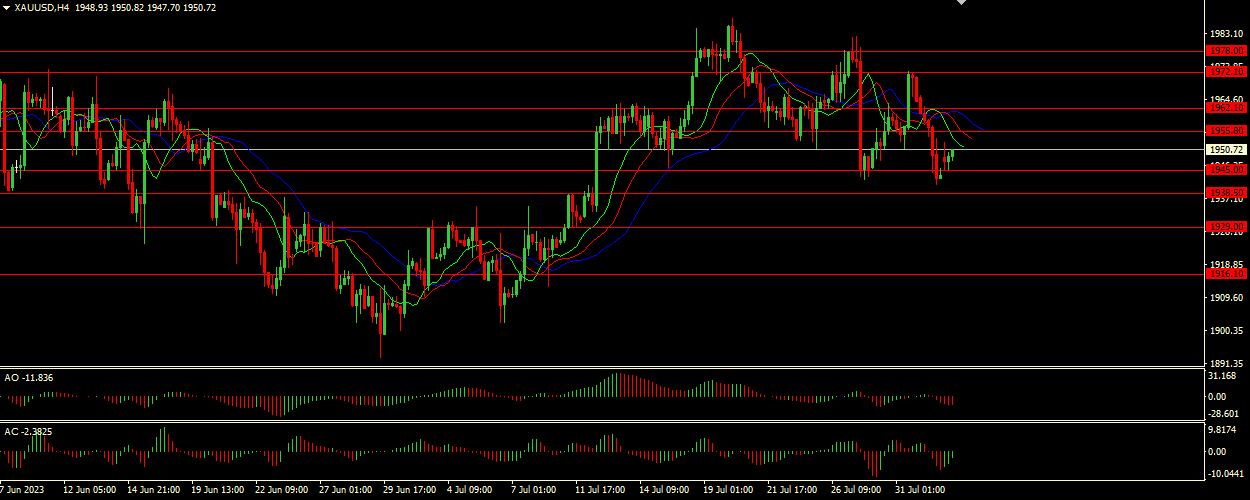

The Alligator indicator, which is in a hungry state with the jaw (blue line) above the lips and teeth (green and red lines), indicates a continuation of the downtrend. AO and AC being in the gray area with divergence does not give a strong signal, but the current downtrend scenario is consistent with the Alligator indicator.

Main scenario (SELL)

Recommended entry level: 1945.00.

Take Profit: 1938.50.

Stop Loss: 1948.00.

Alternative scenario (BUY)

Recommended entry level: 1955.80.

Take Profit: 1962.10.

Stop loss: 1952.00.