Fundamental analysis of WTI

Oil prices rose on Wednesday for several reasons. The key driver of the rise was a significant decline in U.S. crude oil inventories, as evidenced by a weekly decline of 11.5 million barrels, which peaked on August 25. The sharp drop was the largest since September 2016 and exceeded market expectations, signaling strong demand for oil. The decline in inventories underscores the challenges of replenishing supply and signals growing demand for energy.

Another reason for high prices is the threat of Hurricane Idalia in the Gulf of Mexico. Current forecasts suggest the hurricane could move eastward and bypass major sources of oil, but its very presence could lead to potential supply chain disruptions in the region. The Gulf is an integral part of U.S. oil production, accounting for nearly 15% of U.S. oil production. This environmental uncertainty certainly underscores the unpredictable nature of the oil industry.

At the same time, the weakening of the US dollar, driven in part by disappointing July employment figures and global financial conditions, has inadvertently pushed oil prices upward. A weakening dollar will certainly make dollar-denominated oil more affordable for holders of non-dollar currencies. However, the volatility of the US dollar index and monetary policy dynamics require careful consideration.

Internationally, Saudi Arabia is inclined to extend its voluntary production cuts until October. Experts agree that this will lead to higher prices. However, economic uncertainty emanating from China, the world's largest oil consumer, is dampening this optimism. The recent diplomatic tensions, in particular complaints by the US Commerce Secretary and China's policy adjustments, could lead to major fluctuations in global oil supply and demand. In addition, speculation about policy changes by important institutions such as the People's Bank of China, the possibility of a cooling in US-China relations, and the International Monetary Fund's approach in future resource allocation are also important considerations. Overall, the current situation is a two-way stick. On the one hand, demand is expected to increase; on the other hand, there are potential problems for oil buyers and price stability.

Thus, while oil market conditions are trending upwards in the short term, mainly due to declining inventories in the US and the possibility of production cuts in Saudi Arabia, a complex of economic, geopolitical and environmental factors could cause considerable unpredictability.

Technical analysis and scenarios:

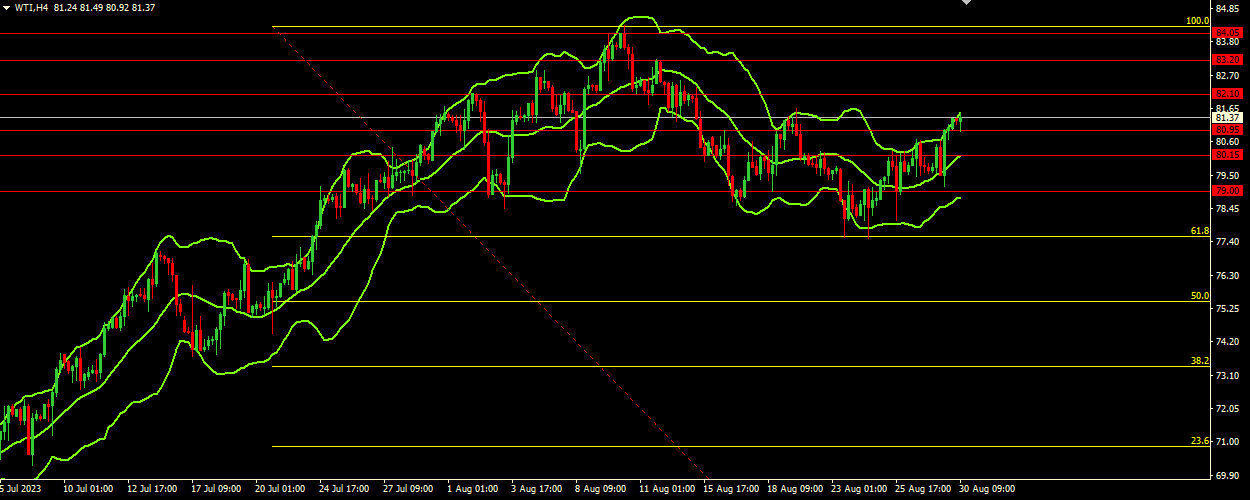

WTI crude oil is currently trading at 81.40, which is slightly below the upper boundary of the Bollinger Bands, which is at $81.50. The direction of the Bollinger Bands is upward and price movement is taking place in the upper range of this indicator. The wide bands indicate the increased volatility in the market. Given the upward direction of the Bollinger Bands and the price near the upper band, a bullish momentum is likely in the coming days.

Main scenario (BUY)

Recommended entry level: 82.10.

Take Profit: 83.20.

Stop loss: 81.40.

Alternative scenario (SELL)

Recommended entry level: 80.95.

Take Profit: 80.15.

Stop loss: 81.40.