Fundamental analysis of XAU/USD

On Wednesday, gold prices are holding near 1930.00.

Public opinion believes that the Fed will maintain current interest rates, but concerns are growing about the possibility of an interest rate hike later this year. Treasury yields remain stubbornly high, suggesting that the market expects a hawkish but passive stance from the Fed. The complexity of the outlook is compounded by rising oil prices and comments from Treasury Secretary Janet Yellen, who emphasized the need to adjust U.S. economic growth and potential interest rates to achieve the inflation target. This economic situation suggests that interest rates may continue to rise over time. The Fed's tightening stance could put downward pressure on gold prices, especially in light of recent U.S. economic data releases.

At the same time, upcoming meetings of central banks around the world, in particular the Bank of England and the Bank of Japan, could have an additional impact on the gold market. Given the importance of monetary policy to the investment environment, rising interest rates could increase the opportunity cost of non-yielding assets and cast a shadow over the precious metals sector. Traders are awaiting the Fed's statement as well as decisions from other central banks, which are expected later this week. Against the backdrop of these macroeconomic conditions, concerns about the state of the U.S. economy are emerging. Strong labor demand, rising wages and consumer spending are colliding with challenges in the manufacturing and housing sectors, requiring policymakers to strike a delicate balance to keep inflation at desired levels. According to an August note by US-based NAB Commodities Research, gold prices could see a decline if the Fed takes a tougher stance, especially on the release of CPI and PPI data.

Technical analysis and scenarios:

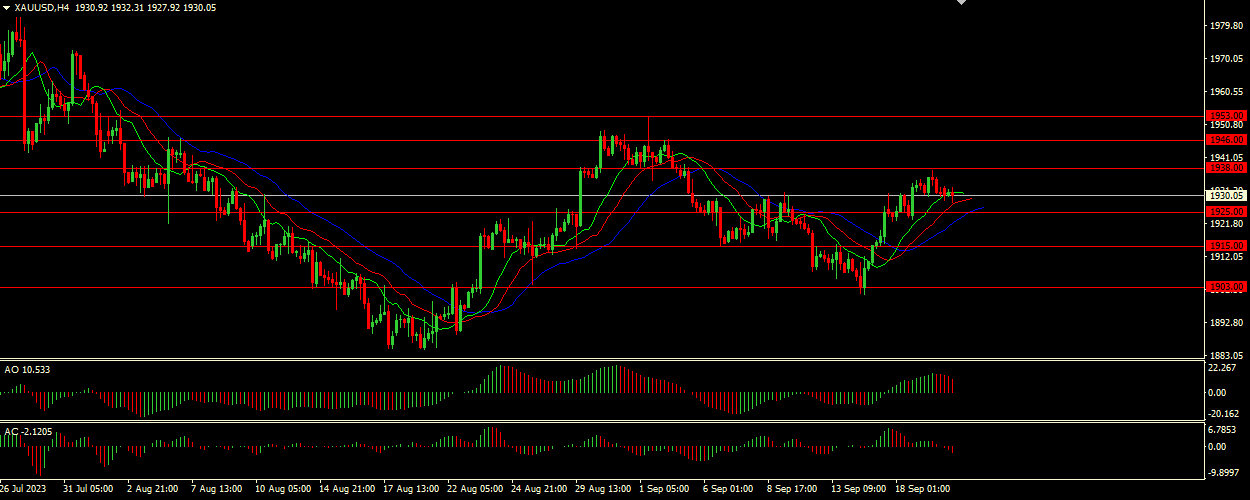

Given the position of the Alligator indicator with its wide open mouth and jaw (blue line) below the lips and teeth (green and red lines), we can conclude that the instrument is currently in an uptrend. However, this uptrend may be nearing completion or a reversal may be possible. The Awesome Oscillator (AO) and Accelerator Oscillator (AC), which are in red, are strong confirming sell signals.

Main Scenario (SELL)

Recommended entry level : 1925.00.

Take Profit: 1915.00.

Stop Loss: 1930.00.

Alternative scenario (BUY)

Recommended entry level: 1938.00.

Take Profit: 1946.00.

Stop loss: 1934.00.