Gold prices (XAU/USD) have experienced mixed movements, holding steady above the $2,500 psychological mark, driven by market reactions to recent US economic data. The key factor influencing gold's price action has been the latest US Consumer Price Index (CPI) report, which suggests that inflation remains persistent, with core CPI rising 0.3% in August and maintaining a 3.2% year-over-year increase. This has tempered expectations for aggressive interest rate cuts from the Federal Reserve, despite initial hopes for a more substantial 50-basis-point reduction.

The likelihood of a 25-basis-point rate cut at the upcoming Federal Reserve meeting now stands at 87%, up from 71% before the CPI data release. This shift has led to a rise in US Treasury bond yields, placing pressure on gold, which traditionally lacks yield. Additionally, the strengthening US Dollar, nearing its monthly high, has added to the headwinds for the precious metal.

Despite these challenges, gold has shown resilience, trading near $2,516, with an intraday high of $2,519. Investors remain cautious as the recent range-bound movement of gold suggests hesitation in the market, with traders looking ahead to the upcoming US Producer Price Index (PPI) report for further insights into inflationary pressures.

In a broader context, the general risk-on sentiment in global markets, spurred by optimism in equity markets, has further capped demand for gold as a safe-haven asset. However, lingering concerns over economic conditions, particularly in China, where deflation risks and trade surpluses continue to pose challenges, have kept gold supported as an attractive option for investors seeking protection against economic uncertainty.

Golds price direction remains uncertain in the near term, as market participants weigh the implications of the Federal Reserveâs monetary policy, inflation trends, and the global economic landscape, including potential economic stimulus measures from China.

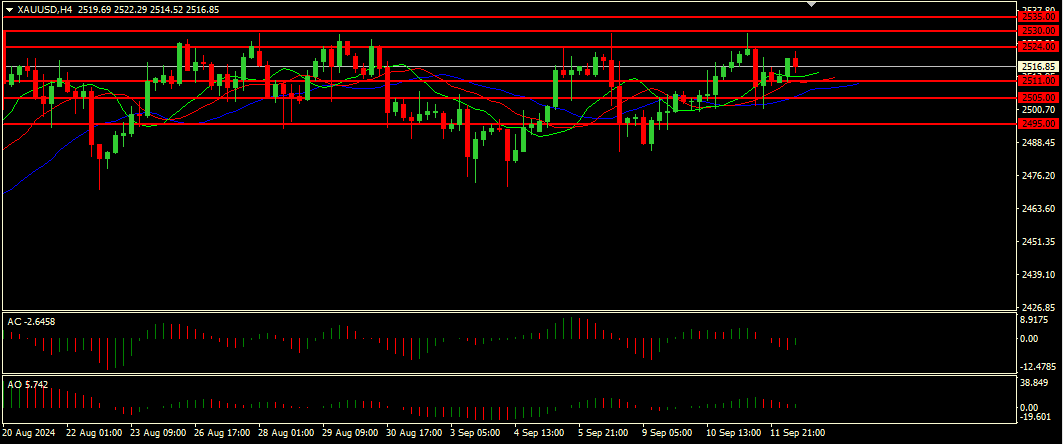

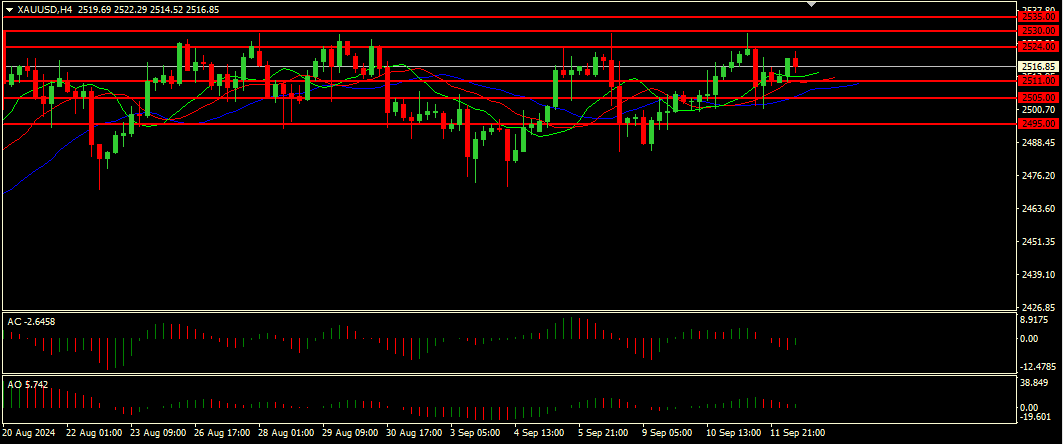

Technical analysis and scenarios:

Given the current price the Alligator indicator suggests that the market is in an uptrend

as its hungry mouth (blue line) is located below the lips and teeth (green and red lines). However,

the Awesome Oscillator (AO) and Accelerator Oscillator (AC) in the green zone near the zero level

indicate a strong buy signal, confirming the initial upside signal from the Alligator.

Main scenario (BUY LIMIT)

Recommended entry level: 2511.00

Take profit: 2524.00

Stop loss: 2505.00

Alternative scenario (SELL)

Recommended entry level: 2505.00

Take profit: 2495.00

Stop loss: 2511.00