General analysis XAUUSD for 19.07.2022

Current dynamics

The XAUUSD continues to trade actively and resumes its downtrend towards the strong psychological support at 1700.00.

Gold corrected on Monday at 1723.82, the highest level that this traditional safe haven asset reached, but by late afternoon the instrument returned to its downtrend. This price movement can be easily explained by the weakening of the U.S. dollar, caused by a decline in traders enthusiasm for the recently expected interest rate hike of 100 basis points at once. Whether it will actually happen, or the rate will be raised by the previously announced 75 basis points, we will know at the end of July during the next meeting of the members of the Federal Reserve, which will be held on the 27th.

The Australian National Bank claimed it expects the downtrend in gold to continue, should it break the support at $1675.00, it will continue southward at 1600.00. According to Laffer, a former adviser to President Reagan, the current situation with unprecedentedly high inflation in this century is caused by excessive monetary stimulation of the economy during the pandemic coronavirus and the only way to correct this imbalance is in the further tightening of monetary policy and reduction of the money supply, which will continue to lead to the strengthening of the dollar and lowering of the XAUUSD quotes.

At the same time, the analyst Hemke thinks that the FRS will be forced to switch over to the dovish policy as some experts believe that the economy is formally entering into recession, the citizens savings are fading, and the increase in consumer prices under an expensive dollar negatively affects the citizens attitude towards the representatives of the Democratic Party, which positions are hardly strong at the moment, which is an unacceptable luxury for the acting President on the threshold of the elections.

Traders interested in dealing this dynamic pair in the near future should pay attention to the following macroeconomic news: The number of construction permits issued tomorrow, Secondary housing market sales (June) and US crude oil inventories the day after tomorrow.

Support and resistance levels

Support and resistance levels

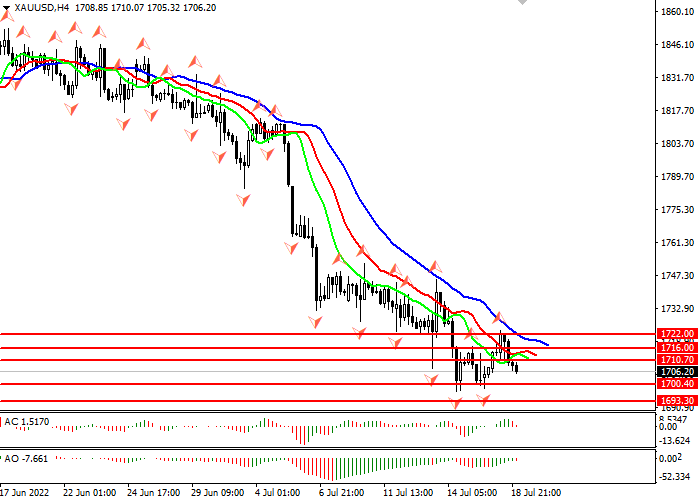

Alligator is hungry: his mouth is wide open, his jaw (blue line) hovers high above his lips and teeth (green and red lines), the instrument is in a downtrend. The nearest fractal below the alligators teeth (red line) is at 1704.93. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the red area, the bars are close to the zero level, which is a strong confirmatory sell signal.

- Support levels: 1700.40, 1693.30, 1683.60.

- Resistance levels: 1722.00, 1716.00, 1710.70.

Trading scenarios

- Long positions should be opened at the 1710.70 with a target of 1716.00 and a stop loss at 1705.00. Implementation period: 1-3 days.

- Short positions can be opened at the level of 1700.40 with a target of 1693.30 and a stop-loss at the level of 1705.00. Implementation period: 1-3 days.