Fundamental analysis of XAU/USD

XAU/USD is currently in swing territory, trading at 1937.00 as traders ponder the potential impact of U.S. labor market trends and upcoming inflation data on the direction of U.S. monetary policy. While a weaker dollar and lower bond yields have supported the precious metal, the way forward remains unclear.

Current market conditions have been driven primarily by slowing US job growth, which has weakened the dollar and bond yields, and contributed to gold's rally last Friday. The U.S. jobs report for July showed slower than expected job growth, indicating that the labor market may be stabilizing. This suggested that the recent Fed rate hike could be the last in an ongoing tightening cycle. However, strong wage growth and a declining unemployment rate suggest that the labor market remains tight, providing an opportunity to assess the Fed's future interest rate decisions. In light of these mixed signals from the labor market, attention now turns to the upcoming consumer price index (CPI) data due on Wednesday. This data will be key in determining whether further rate hikes are needed to curb inflation. If interest rates rise, gold, traditionally a hedge against inflation, could lose its appeal.

In addition, the gold price is under pressure towards the support level of 1916.10 USD due to the general strength of the US dollar and mixed sentiment ahead of upcoming inflation data from the US, China, China, Australia and New Zealand. UK growth data this week and trade data from China will also play an important role as the market continues to look for distinct trends. Recent hawkish comments from Fed Chair Michelle Bowman and rising geopolitical tensions around China are also weighing on XAU/USD. In addition, the gold market is consolidating in anticipation of demand from India, a major player in the XAU/USD market, also holding the metal ahead of key US data/events. While the negative employment data provides some consolation for gold, it may take a significant weakening of the dollar for it to make serious gains. Until such conditions occur, the gold market will remain volatile and traders should exercise caution.

Gold traders should keep an eye on the Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) for July on Friday. Positive inflation data could allow gold sellers to break below the aforementioned key support line, which could spell trouble for the bulls.

Technical Analysis and Scenarios:

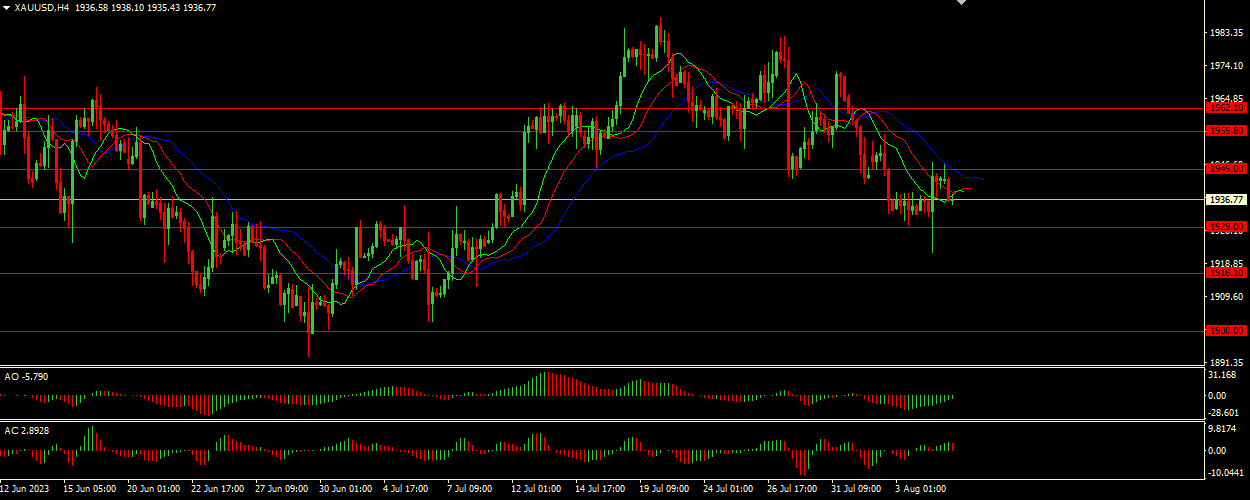

Given the Alligator's position with its jaws wide open and its jaw (blue line) well above its lips and teeth (green and red lines), it is clear that gold is in a downtrend. This suggests that the main scenario could be a continuation of the bearish move. Both the Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the gray area, indicating that there is a divergence. This is usually not a reliable signal to open positions, so traders should be cautious and consider other factors or wait for additional confirmation before deciding to trade.

Main Scenario (SELL)

Recommended entry level: 1929.00.

Take Profit: 1916.00.

Stop Loss: 1936.00.

Alternative scenario (BUY)

Recommended entry level: 1945.00.

Take Profit: 1955.80.

Stop loss: 1936.00.