Fundamental analysis of WTI

WTI crude oil price is hovering at 82.35, pointing to concerns about a drop in Chinese oil demand following news on trade and inflation, as China is the largest oil consumer. These concerns were heightened when China's crude oil imports fell 18.8% in July. However, there is a positive side to the U.S. Energy Information Administration's monthly report. With GDP growth forecast for 2023 rising from 1.5% to 1.9% and crude oil prices rising since June, largely due to a prolonged voluntary production cut in Saudi Arabia and rising global demand, this is an optimistic sign. This optimism is also supported by Saudi Arabia's recent announcement to extend its voluntary oil production cuts and Russia's plan to cut oil exports in September.

The overall trend is for oil prices to rise for the sixth consecutive week, mainly due to OPEC+ supply cuts and China's fiscal stimulus plan. This optimism is also supported by the U.S. Energy Information Administration's forecast of record U.S. oil production in 2023 - 12.76 million barrels per day. However, the results of trading since the beginning of the week so far indicate that further growth in oil prices is unlikely. Such sentiment is driven by concerns over the slow recovery of the Chinese economy combined with fears of slowing consumer demand in the US and Europe due to the possibility of interest rate hikes. According to forecasts, the price of WTI crude oil may fluctuate between 75-85 USD in the next few weeks.

Oil markets will look forward to changes in US crude oil inventories as well as key indicators such as the Consumer Price Index (CPI) and Retail Price Index to determine the future direction. These developments have a significant impact on the WTI price and are likely to determine future trading strategies for oil prices.

Technical Analysis and Scenarios:

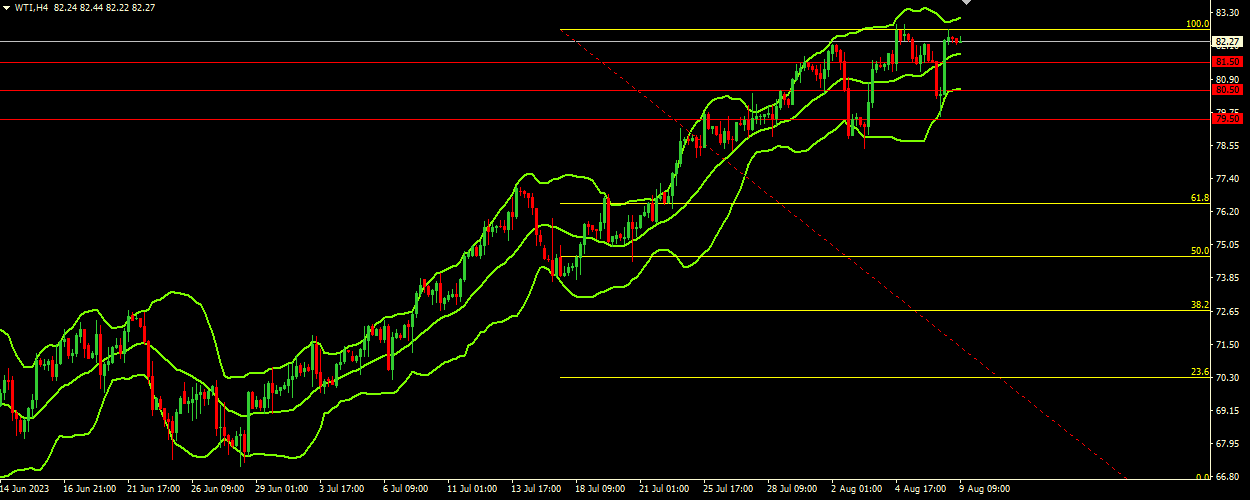

Price is trading in the upper range of the Bollinger Bands, indicating potential upward momentum. The wide price range indicated by the Bollinger Bands also suggests increased volatility. The upward direction of the bands indicates the possibility of this trend continuing, at least in the near term.

Main scenario (BUY)

Recommended entry level: 82.50.

Take Profit: 85.00.

Stop loss: 80.50.

Alternative scenario (SELL)

Recommended entry level: 81.50.

Take Profit: 80.50.

Stop loss: 82.00.