Fundamental analysis of GBP/USD

The GBP/USD pair is trading around 1.26900, recovering from a one and a half month low as traders await the release of important economic data from the UK and the US. This small rally comes despite a cautious atmosphere in global markets and uncertainty surrounding major risk events.

The US Dollar Index, which recently posted its first daily drop in four sessions, is now around 103.10, influenced by weak inflation figures. The New York Fed recently noted that its one-year inflation expectations for July fell to 3.5%, a low not seen since April 2021. However, the same survey cited confidence in the labor market and global economic transformation. Comments from US Treasury Secretary Janet Yellen contributed to market sentiment. Downplaying concerns about the risk of recession in the US, Secretary Yellen pointed to global economic risks related to the economic situation in China, the conflict between Russia and Ukraine and climate cataclysms. Futures on the S&P500 index showed modest gains, while the 10-year U.S. Treasury bond yield is near its highest levels since November 2022. Retail sales data should have important implications. If July retail sales beat expectations for a 0.4% increase (vs. +0.2% in June), it could prompt the Federal Reserve to consider raising interest rates to combat consumption price inflation. In contrast, New York State manufacturing data, due to its smaller contribution to the US economy, is expected to have minimal impact on the Fed's decisions.

In the UK, according to the Chartered Institute of Personnel Management and Development (CIPD), HR directors expect average pay to rise by 5%, the same as the previous two quarters and the highest ever. This sentiment reinforces the Bank of England's (BoE) hawkish outlook, especially after recent positive data on economic growth in the UK. Any jump in wage growth will support a more hawkish stance from the Bank of England. Economists expect median wages to rise at an annualized rate of 7.3% in July, up from 6.9% in June. Economic data from China also failed to worry investors as the recent rate cut by the People's Bank of China offset the negative data.

Today, the market will focus on the outlook for the UK labor market, especially wage growth, which is a key determinant of monetary policy decisions. Over the next few days, the focus will be on the UK unemployment rate data, which is expected to remain at 4.0% in the three months to June, along with an expected improvement in average earnings over the same period.

Technical Analysis and Scenarios:

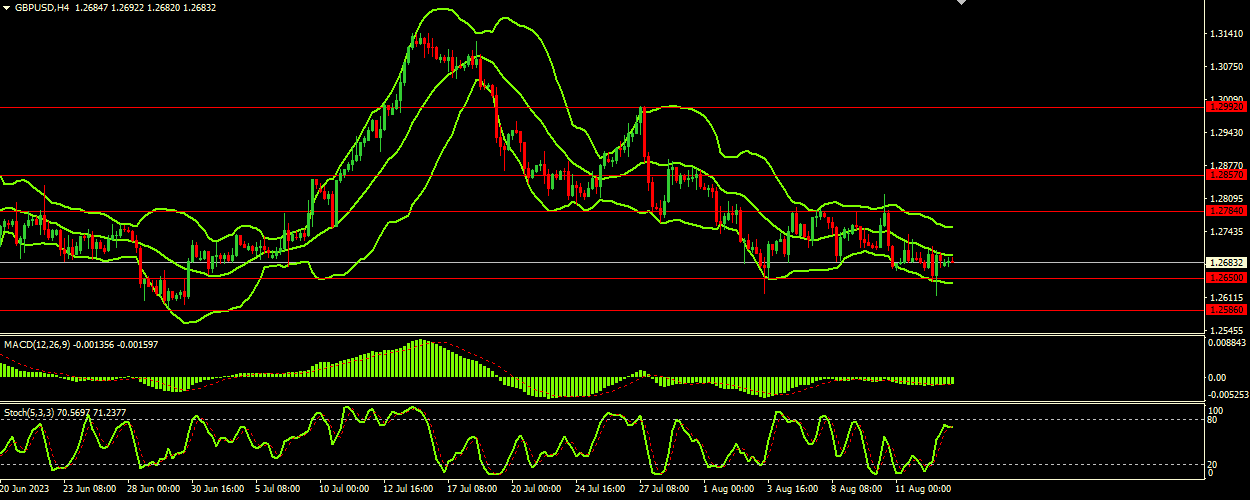

Stochastic indicates that the currency pair is approaching an overbought zone, as values above 70 usually indicate overbought. The price is rising in the lower range of the indicator and the bands are wide, which may indicate volatility and potential price movement in the coming days. The MACD value is above its signal line, indicating bullish momentum in the short term. As the MACD is above its signal line and the GBP/USD price is rising in the lower range of the Bollinger Bands, we may see a push towards resistance levels. If the pair successfully breaks the nearest resistance level at 1.27840, it could signal a move towards 1.28570.

Main scenario (BUY)

Recommended entry level: 1.27840.

Take Profit: 1.28570.

Stop Loss: 1.27350.

Alternative scenario (SELL)

Recommended entry level: 1.26500.

Take profit: 1.25860.

Stop loss: 1.26900.