Fundamental analysis of WTI

Oil prices are in a slump, driven by deep concerns about China's economic trajectory and the possibility of interest rate hikes in the US. These are the world's largest economies and any perturbations in them could affect global oil demand.

The bearish sentiment around oil is driven by many factors. The main ones are the vulnerability of China's economy and the prevailing risk aversion in the US. In addition, the strong US dollar dynamics only reinforces these problems, putting additional downward pressure on oil.

China's real estate sector is struggling, exacerbating the economic problems. Disruptions in mortgage payments and falling home prices underscore the difficulties associated with slowing Chinese real estate growth. Skepticism is emerging even as China's central bank cuts rates, twice in the past three months. Doubts are arising about the ability of such interventions to effectively halt the downward economic trend.

U.S. oil tanks have had their ups and downs. Previous declines were attributed to increased refining and robust exports. However, total production has now already surpassed the levels seen since the pandemic began, resulting in a significant drop in fuel consumption. Refinery activity has reached an all-time high since early 2020, demonstrating a willingness to meet both domestic and international demand. At the same time, increased U.S. oil exports abroad are playing a large role in reducing inventories.

Another aspect adding to the multifaceted oil landscape is the US Federal Reserve's approach to interest rates. The latest data from the July meeting showed positive inflation dynamics, which may interrupt the pause in interest rate hikes. This tactic could impact the economy and thus oil demand. With multiple concerns, a slowing Chinese economy and the possibility of interest rate adjustments in the US due to broader financial uncertainty, sentiment in the oil market is bearish. This group of concerns casts a shadow of uncertainty over oil's future prospects, forcing traders and investors to proceed with caution.

Technical analysis and scenarios:

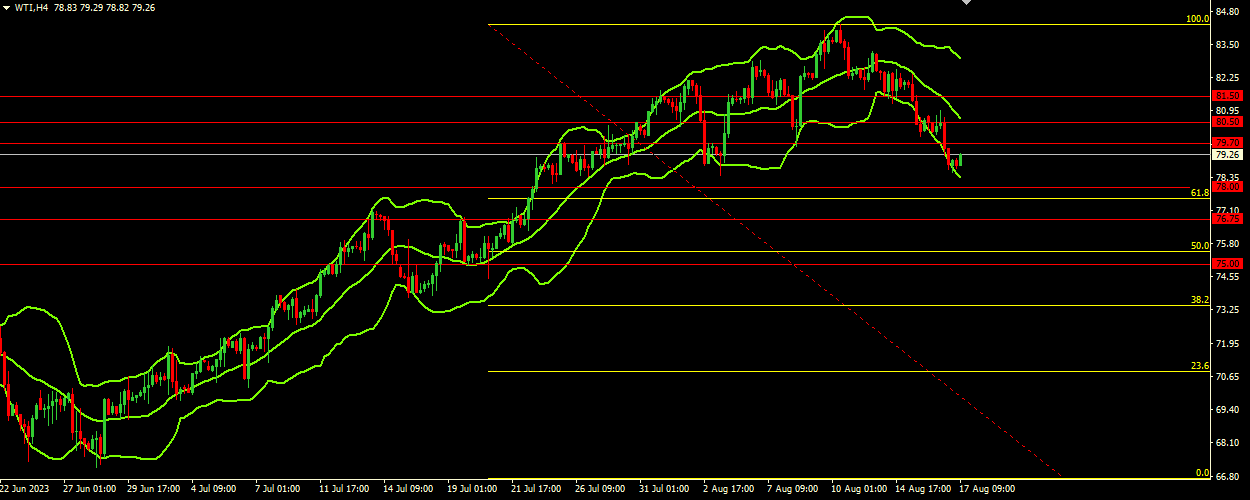

Given the current state of the Bollinger Bands, with the price trading in the lower range of the indicator and the direction of the indicator pointing downwards, the bearish sentiment in the market is emphasized. The widening of the price range indicates an increase in volatility. Given that the price is near the first resistance level ($79.70) and within the lower range of Bollinger Bands, there is a possibility of a small upward bounce.

Main scenario (BUY)

Recommended entry level: 79.70.

Take Profit: 80.50.

Stop loss: 79.50.

Alternative scenario (SELL)

Recommended entry level: 78.00.

Take Profit: 76.75.

Stop loss: 78.50.