GBP/USD Fundamental Analysis

The GBP/USD pair is actively trading in an uptrend, having risen to the level of 1.26100.

The key role in this achievement was played by the comments of Bank of England (BoE) Deputy Governor Ben Broadbent. He took a tough stance on monetary policy over the weekend, emphasizing the need for a prolonged period of tightening to keep inflation under control. Fears remain high despite Broadbent's hawkish remarks at the Jackson Hole symposium, where he emphasized the need to raise long-term interest rates. If interest rates remain high, the UK economy could fall into recession. Of the UK economic data, the main focus will be on the final manufacturing PMI, but the Bank of England's next statement will also attract attention. The focus this week will be on monetary policy divergence based on US economic data.

Economic data from the UK may be scarce, but markets are eagerly awaiting news from the US. The results of indicators such as the US consumer confidence index and the JOLT employment index are likely to influence the direction of Fed policy. Rising consumer confidence and job growth could tilt the Fed in favor of tighter policy. On the other hand, a drop in consumer confidence could lead to spending cuts and inflationary pressures due to lower demand. In addition, broader developments affecting the US dollar are also important. The US Dollar Index, which measures the performance of the US dollar against six other major currencies, is currently trending downward and is trading near 103.950. This downtrend is partly attributed to China's recent fiscal policy efforts to attract investors to the volatile equity market, which increases risk sentiment and reduces the dollar's attractiveness as a safe haven currency.

In conclusion, the direction of GBP/USD remains the subject of active speculation as traders and investors await the release of data from the US, including key indicators such as employment and consumer confidence.

Technical analysis and scenarios:

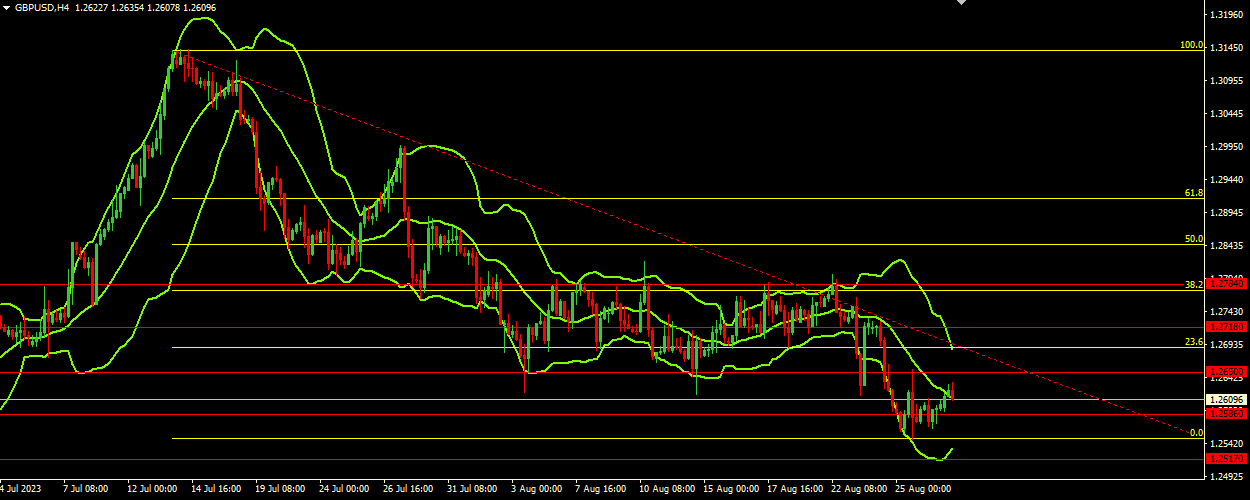

GBP/USD is currently trading at 1.26100, which is near key resistance at 1.26500. Given that price is rising in the upper range of the Bollinger Bands, there is potential for a bullish breakout. Despite the current bullish bias, if sellers manage to take control and push the price below the current support at 1.25860, it could open the way for further losses to reach the next major support at 1.25170. The lower Bollinger Bands at 1.25360 is also in line with this scenario, acting as a potential dynamic support.

Main scenario (SELL)

Recommended entry level: 1.25860.

Take Profit: 1.25170.

Stop loss: 1.26150.

Alternative scenario (BUY)

Recommended entry level: 1.26500.

Take Profit: 1.27180.

Stop loss: 1.26150.