Fundamental analysis of XAU/USD

Gold prices (XAU/USD) are showing strength, trading at 1943.70, and have recently reached a high since early August, supported by a number of factors, including a weaker US Dollar on speculation over future Federal Reserve decisions. Over the past few days, the US Dollar Index has pared gains, consolidating at 104.05, amid mixed data on the US economy that suggests the Federal Reserve may maintain its current interest rate policy at its next meeting in September.

In addition, a series of economic measures aimed at stimulating the economy of China, a global powerhouse and one of the largest consumers of gold, pushed the XAU/USD exchange rate higher. Notable measures include the government's efforts to revitalize the private sector, as well as significant adjustments such as the People's Bank of China's reduction in the required reserve ratio. In addition, some Chinese banks have adjusted RMB deposit rates. The disappointing performance of US Treasury yields over the past few weeks has contributed to gold prices, especially as the XAU/USD pair remains steady above key technical support levels. Despite the recent US dollar rally, this momentum appears to be waning, which indirectly boosts gold's appeal. However, the prospect of further rate hikes later this year could limit the dollar's decline and thus limit gold's upside.

The general consensus is that the Federal Reserve may soon complete a trajectory of interest rate hikes following the release of the latest employment data. These trends, combined with continued high US interest rates driven by ongoing inflation, mean that gold's upside potential is limited as the opportunity cost of owning gold increases. Market attention has now shifted to upcoming Fed officials' statements and additional economic data, as well as notable events such as the US services PMI and US inflation data.

Technical analysis and scenarios:

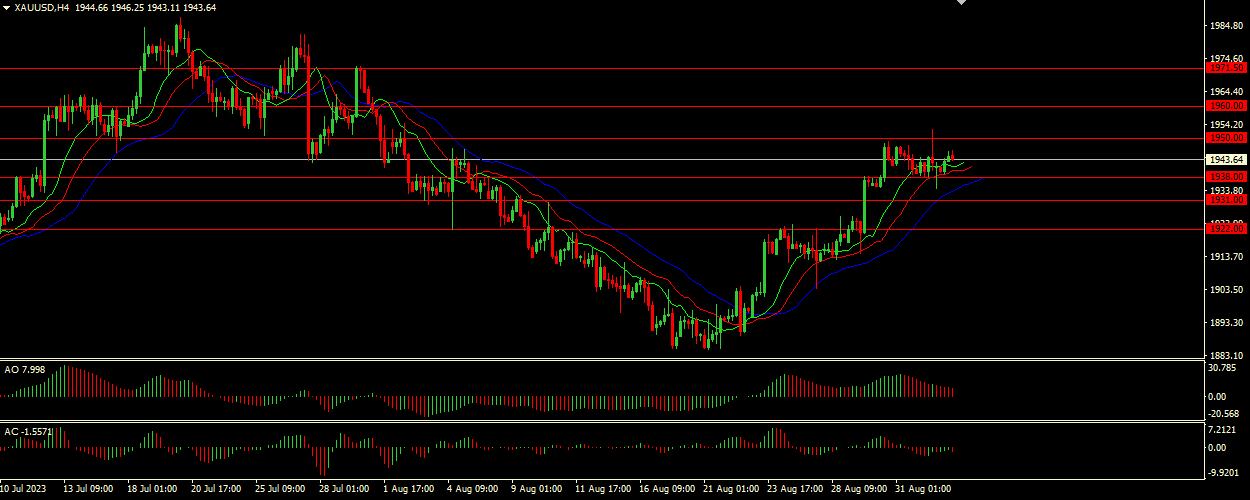

Given the current bullish trend as evidenced by the "hungry alligator" with its mouth wide open and jaw below its lips and teeth, the main scenario predicts further upward momentum for XAU/USD. With the Awesome Oscillator (AO) and Accelerator Oscillator (AC) in the red zone near the zero level, there is a strong confirmatory sell signal indicating a possible bearish reversal. Refrain from opening positions until there is a clear breakout (either up or down). Monitor the price movement and oscillators closely for clearer indications.

Main Scenario (BUY)

Recommended entry level: 1950.00.

Take Profit: 1960.00.

Stop Loss: 1945.00.

Alternative scenario (SELL)

Recommended entry level: 1938.00.

Take Profit: 1931.00.

Stop loss: 1945.00.