Fundamental analysis of XAU/USD

Gold prices remained cautious on Tuesday, trading around 1919.70 as traders' attention focused on upcoming U.S. inflation data, which serves as an indicator for investors and future interest rate actions by the Federal Reserve, which hinted at further policy tightening.

While the recent decline in the dollar has had a small impact on gold, making it a more attractive option for traders in other currencies, rising Treasury bond yields have limited that impact somewhat. The key to traders' strategy lies in the US consumer price index data released on Wednesday. It is considered by many to be an important indicator in determining the Fed's interest rate path in the coming months. Market rumors suggest that another interest rate hike is possible this year. The CME FedWatch tool gives a 93% probability that the Fed will maintain its current stance in September. However, between now and November, the probability of a rate hike is 41%. While the Fed is hesitant to significantly raise interest rates, it appears that the agency has yet to decide on its strategy. Gold's rise depends on a number of factors: a decrease in the Fed's aggressiveness, a drop in the dollar index and Treasury yields. However, until CPI data is released, the market is expected to remain inactive. CPI results equal to or higher than forecasts could reduce gold's upward momentum in the near term.

External factors such as concerns over deteriorating economic conditions in China and rising borrowing costs are reducing demand for investment in riskier companies, pushing investors towards the safety provided by gold. However, traders remain cautious, preferring to remain on the sidelines until the release of US consumer price index data. Added to this is Thursday's European Central Bank meeting, which promises to breathe new life into gold's price rally. Speculation over the ECB's future actions continues unabated, with analysts divided over its future interest rate decisions amid a gloomy economic outlook for the Eurozone.

Ultimately, central bank actions and the release of key data will determine the future direction of gold prices, which emphasizes the importance of watching for any strong buying trends before making your next investment decision.

Technical Analysis and Scenarios:

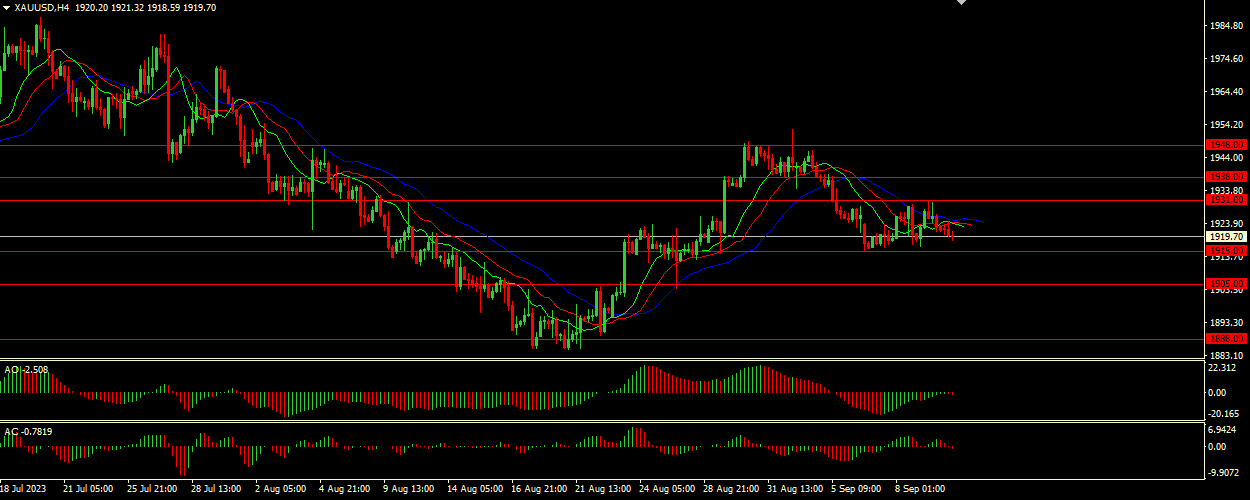

The alligator is hungry, indicating a strong downtrend. Since the jaw (blue line) is well above the lips and teeth (green and red lines), this indicates prevailing selling pressure in the current scenario. The Awesome Oscillator (AO) and Accelerator Oscillator (AC) are located in the red zone, near the zero level. This proximity to the zero level is a strong confirmatory sell signal.

Main scenario (SELL)

Recommended entry level: 1915.00.

Take Profit: 1905.00.

Stop Loss: 1920.00.

Alternative scenario (BUY)

Recommended entry level: 1931.00.

Take profit: 1938.00.

Stop loss: 1927.00.