Fundamental analysis of WTI

WTI crude oil prices are trending higher and have reached their highest level since November 2022 at 90.57. This increase is due to a number of factors pointing to the prospect of higher oil prices in the near future.

Chief among these factors is China's strong economic performance. Industrial production and retail sales figures for August were better than expected, indicating a consistent recovery from the COVID-19 pandemic. This strong economic performance complements China's record refinery throughput, which reached 64.69 million tons in August, up 20% year-on-year. This increase can be attributed to high tariffs imposed during the summer tourist season and favorable profit margins on exports to other Asian consumers.

Major oil producing countries such as Russia and Saudi Arabia have decided to cut production. Such measures have raised fears of a looming supply shortage, especially in light of last month's OPEC+ resolution and the International Energy Agency's forecast of a market deficit throughout the fourth quarter as Saudi Arabia and Russia extend oil production cuts. Looking ahead, Saudi Arabia's oil production is expected to be at 1.3 million barrels per day during the period. Underpinning this sentiment, OPEC is optimistic about Chinese oil demand through 2023 and forecasts significant growth in global oil demand in 2023 and 2024.

However, some potential headwinds could cause volatility in the market. The world continues to look toward China, the world's largest oil importer. Any significant slowdown in industrial activity and oil consumption in that country could have a global impact, possibly pushing WTI crude oil prices lower. In addition, central banks around the world are adjusting their positions. While the European Central Bank raised its benchmark interest rate, the U.S. Federal Reserve is expected to maintain the current interest rate at its next meeting in September. China's central bank, on the other hand, is looking to increase liquidity and promote economic recovery by reducing banks' liquidity reserve requirements.

Looking ahead, oil traders are awaiting key data releases such as China's retail sales and industrial production data, as well as the Michigan consumer confidence index. This data could significantly impact the price of WTI in USD and thus shape trading strategies.

Technical analysis and scenarios:

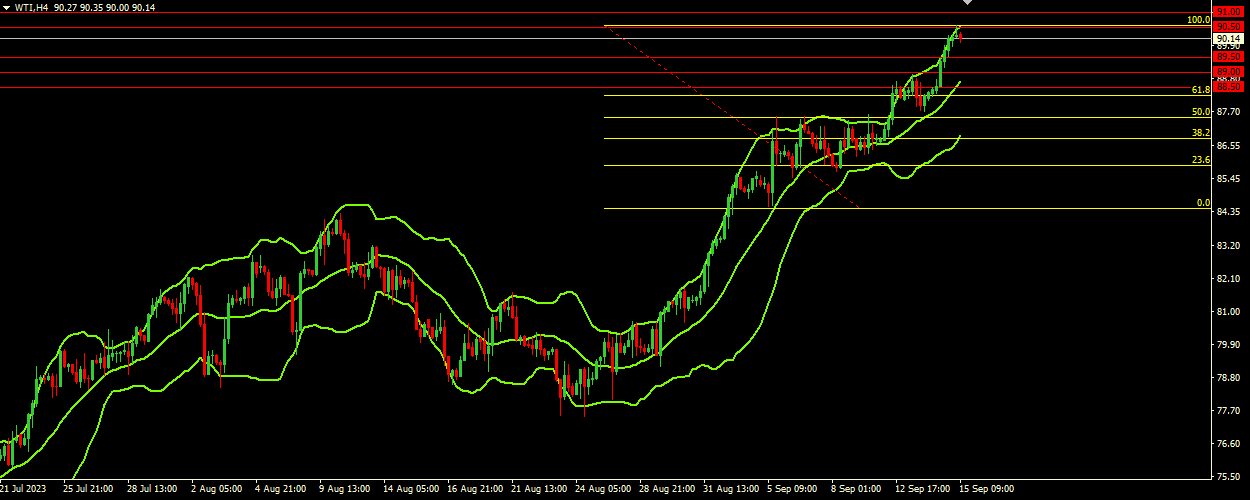

The WTI crude oil price is currently at 90.00 and is near the highs of the past few years. The price is aligned with the upper Bollinger Bands at 90.50, indicating potential overbought conditions. If the price manages to break through and consolidate above the nearest resistance at 90.50, it may indicate a continuation of the bullish momentum. In this case, the recommended buy entry will be at 90.50. Given that the price is declining towards the upper range of the Bollinger Bands, there is a possibility of a bearish reversal. Although the prevailing sentiment around WTI crude oil prices looks bullish, traders should remain vigilant on the above scenarios and adjust their strategies depending on price action and key technical levels.

Main scenario (BUY)

Recommended entry level: 90.50.

Take Profit: 91.00.

Stop Loss: 90.30.

Alternative scenario (SELL)

Recommended entry level: 89.50.

Take Profit: 89.00.

Stop loss: 89.70.