Fundamental analysis of XAU/USD

Gold (XAU/USD) is trending higher and is trading at 1928.50. This rally has been boosted by December gold futures, which rose by 4.70 USD. This uptrend coincides with the weak sentiment in Asian equities, while precious metals are being strengthened by a range of global factors.

The US Federal Reserve's next monetary policy meeting remains a top priority. Most expect the Fed to leave interest rates unchanged, but market speculation still points to the possibility of a 25 basis point rate hike in November or December. However, the resilience of the U.S. labor market, controlled inflation and rapid economic growth paint a picture in which the Fed could signal a soft landing for the economy. At the same time, the recent depreciation of the dollar based on recent US data has made gold more accessible to those trading in alternative currencies, making spot gold significantly more expensive each week.

Amid growing concerns about the economic situation in China, investors are turning to gold, especially in light of recent troubling news related to Evergrande Group's decision to postpone its debt restructuring. China's conservative fiscal policy and the implications of this corporate move are putting pressure on global risk sentiment and encouraging investment in gold as a safe haven.

Geopolitical tensions manifested in the auto workers union strike against Detroit's largest automaker, combined with Chinese consumers seeking protection from a weaker yuan, makes gold more attractive. Rising demand in China has been reflected in a surge in spot gold prices, which have reached unprecedented levels. However, with expectations of a soft landing and continued high interest rates, investors are looking for new catalysts to resume the uptrend.

Investors will be keeping an eye on decisions from other major central banks, including the Swiss National Bank and the Bank of England, as well as the Bank of Japan's decision later this week. Meanwhile, Canadian and UK consumer inflation data is also expected to provide important trading information for gold enthusiasts. As gold is very sensitive to interest rate movements, Fed Chairman Jerome Powell's comments after the policy meeting and subsequent policy statements will be important factors in determining gold's future position.

Technical Analysis and Scenarios:

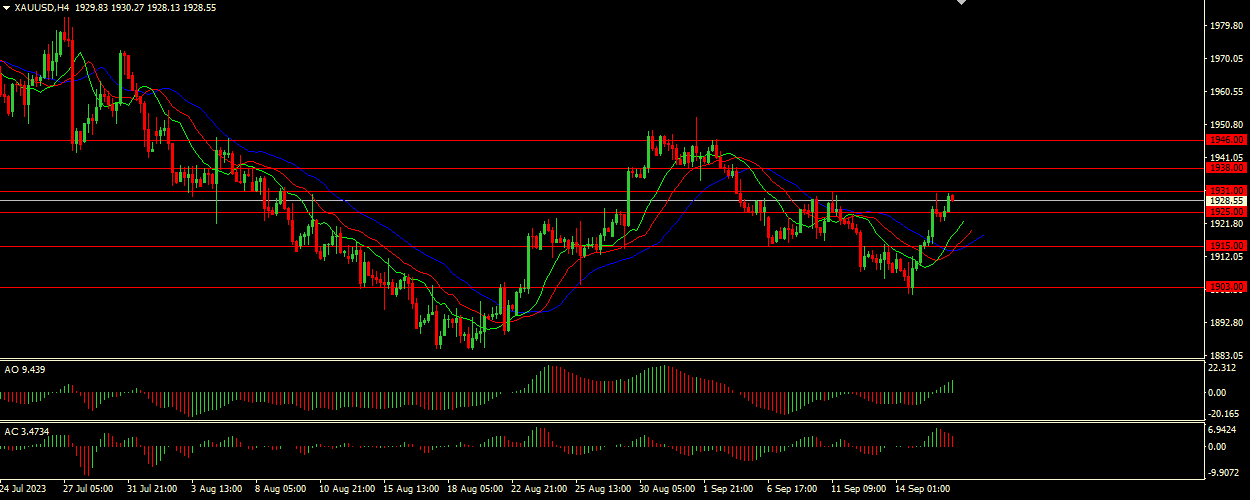

Alligator indicates bullish sentiment with the jaw wide open and the jaw (blue line) below the lips and teeth (green and red lines). The Awesome Oscillator (AO) and Accelerator Oscillator (AC) are located in the gray area, indicating a divergence. This introduces uncertainty and cannot serve as a reliable signal to start trading. Given the current uptrend and the support provided by the Alligator indicator, the ideal buy entry would be just above the current price at 1931.00.

Main scenario (BUY)

Recommended entry level: 1931.00.

Take Profit: 1938.00.

Stop Loss: 1928.00.

Alternative scenario (SELL)

Recommended entry level: 1925.00.

Take Profit: 1915.00.

Stop-loss: 1930.00.