Fundamental analysis of XAU/USD

Fundamental analysis of XAU/USD shows a bullish trend supported by a combination of geopolitical tensions, economic indicators and market expectations.

Gold prices remain strong, holding above $2025 and near $2060/oz, reflecting its dual role as an inflation hedge and safe-haven asset. Rising international tensions, especially the ongoing conflict between Israel and Hamas and the US military campaign in Yemen, have reinforced this trend. This geopolitical crisis is forcing investors to choose safe-haven assets, thereby boosting gold prices.

Another important factor is the US economic data. The sudden drop in producer prices has led to a decline in government bond yields, making gold an attractive investment. In addition, the market expects the US Federal Reserve to cut interest rates in March, which could have an impact on gold prices. Stability in short-term interest rates and lower interest rates later this year will further strengthen gold's position in the market.

Upcoming economic reports such as the manufacturing activity index, retail sales and the Michigan consumer confidence index are expected to play an important role in shaping future trends. However, current data indicates that the uptrend will continue, making gold an attractive option for traders looking for stability and growth.

Technical analysis and scenarios:

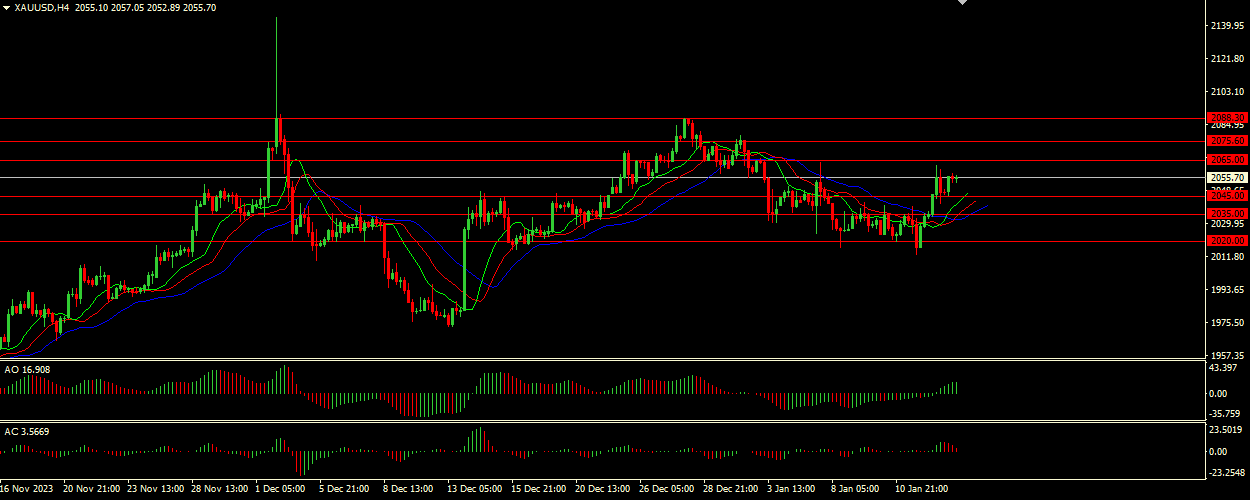

The alligator is "hungry", indicating an uptrend. This can be seen by the positioning of the jaw (blue line) below the lips and teeth (green and red lines). The Awesome Oscillator (AO) and Accelerator Oscillator (AC) are both in the gray area showing divergence. This indicates uncertainty in the market, indicating that this is not a good time to open new positions.

Main scenario (BUY)

Recommended entry level: 2065.00.

Take Profit: 2075.60.

Stop-loss: 2060.00.

Alternative scenario (SELL)

Recommended entry level: 2045.00.

Take profit: 2035.00.

Stop-loss: 2050.00.