Fundamental analysis of WTI

The WTI crude oil market is currently operating in a challenging environment influenced by strong OPEC demand forecasts, geopolitical risks, US inventory differentials, monetary conditions, production changes and alternative views on future oil demand.

OPEC expects strong growth in global oil demand, increasing by 2.25 million barrels per day in 2024 and 1.85 million barrels per day in 2025. The positive outlook emphasizes demand growth, especially from China and other countries. The Middle East region is at risk as the International Energy Agency predicts that oil demand will increase by 2030 due to the transition to green energy. This is contrary to the prevailing view. Oil markets have been hit hard by geopolitical and supply issues. In particular, Houthi attacks have exacerbated supply problems in the Red Sea, leading to increased cargo and transportation costs. Recent incidents include attacks on U.S. cargo ships and U.S. attacks on Houthi targets.

The American Petroleum Institute reported an unexpected rise in US crude oil inventories, contrary to expectations of a decline. Thus, despite OPEC's optimism about long-term demand forecasts, short-term pessimism persists. Market participants are watching incoming data from the Energy Information Administration for more information.

Production problems have also affected the supply side, with bad weather in North Dakota significantly slowing production. OPEC decided to cut production to support the market, but global production has risen slightly, especially in Nigeria. As non-OPEC supply growth slows, the group's market share is expected to recover in the future. In the short term, the market is likely to be bearish, influenced by short-term factors such as US inventory data and geopolitical concerns rather than longer-term valuations. Traders are advised to pay attention to rapid market changes and updates, especially from major organizations such as the EIA and API. With Brent prices characterized by low volatility and showing a bearish trend, it is worth trading with caution in the short term.

Technical analysis and scenarios:

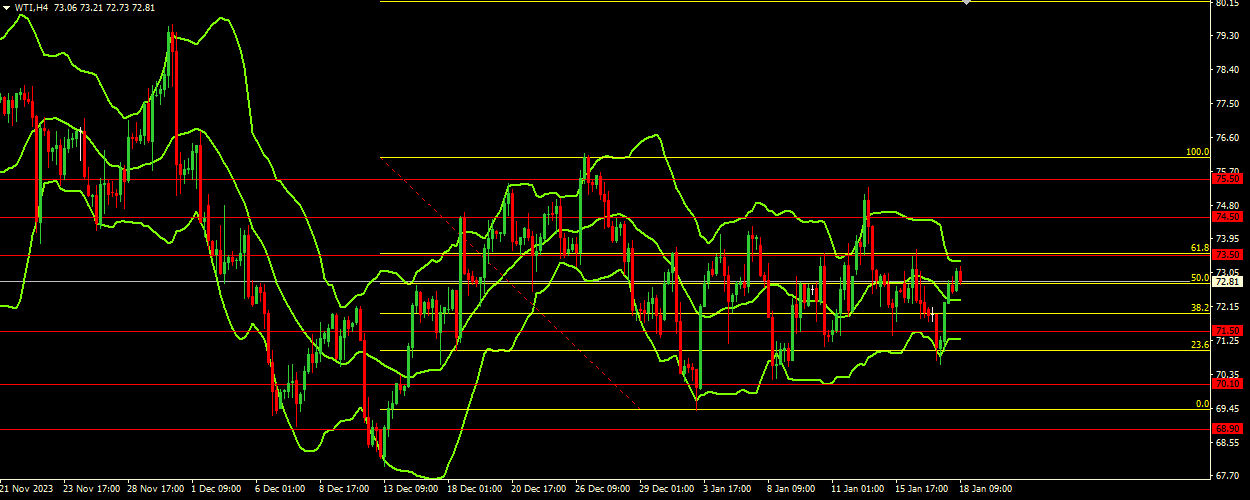

The current price of WTI crude oil is at 72.85. It is important to consider the identified support and resistance levels to anticipate potential price movement. The nearest support levels are at 71.50, 70.10 and 68.90, while resistance levels are at 75.50, 74.50 and 73.50. Bollinger Bands are a key indicator for analyzing price volatility and potential price trends. The upper band is at 73.30, the middle band (which also acts as a 20-period moving average) is at 72.30, and the lower band is at 70.30. The bands are horizontally directed, indicating that the market is in a consolidation phase without a clear trend. The wide range between the bands indicates a high level of volatility.

Main scenario (SELL)

Recommended entry level : 71.50

Take Profit: 70.10

Stop Loss: 72.00

Alternative scenario (BUY)

Recommended entry level: 73.50

Take Profit: 74.50

Stop loss: 73.00