Fundamental analysis GBPUSD for 21.02.2024

The current analysis of GBP/USD shows that the price movement has no clear direction, as economic conditions in the US and UK show uncertainty, as do expectations related to central bank policies and economic data releases.

Sterling failed to hold gains despite hitting a weekly high near 1.26800, which was particularly influenced by comments from Bank of England officials. Governor Andrew Bailey said market expectations for a rate cut were not "unreasonable" and pointed to signs of easing price pressures, but did not say when or how much policy adjustments would be made. Deputy Governor Ben Broadbent and Policy Director Swati Dhingra also attended the meeting, emphasizing the shift in focus from the scope to duration of restrictive monetary policy and warning of the negative effects of high interest rates on the economy. Analysts argue that interest rate cuts are urgently needed to avoid long-term economic damage, but concerns remain about the impact of continued tight monetary policy on UK economic growth.

Minutes from the US Federal Reserve's January meeting are eagerly awaited to provide insight into interest rate decisions and the market awaits details on the reasons for keeping interest rates unchanged. The US Dollar Index showed some resilience, supported by Fed policymakers' confidence in the direction of inflation, leading to a broad-based decline in the dollar against a basket of major currencies. Economic indicators such as the PMI data for February and the GDP and inflation report have so far played a key role in shaping market expectations and sentiment.

Investors remain cautious, keeping an eye on possible hawkish statements from Fed officials and awaiting further guidance on future interest rate decisions. Future PMI readings for the UK and US are likely to fluctuate due to expected differences in economic activity in the services and manufacturing sectors. In the case of the UK, a slight decline in the key services sector and a continued downturn in manufacturing could influence the direction of the Pound, while the expected economic growth rate is likely to be weaker than the US economic data. This could mean increased investor interest in the pair. Overall, the GBP/USD exchange rate development is very balanced and is influenced by central bank announcements, economic data releases and global market sentiment. Investors and analysts will keep a close eye on future economic data and policy updates for further clues on the direction of this important currency pair.

Technical Analysis and Scenarios:

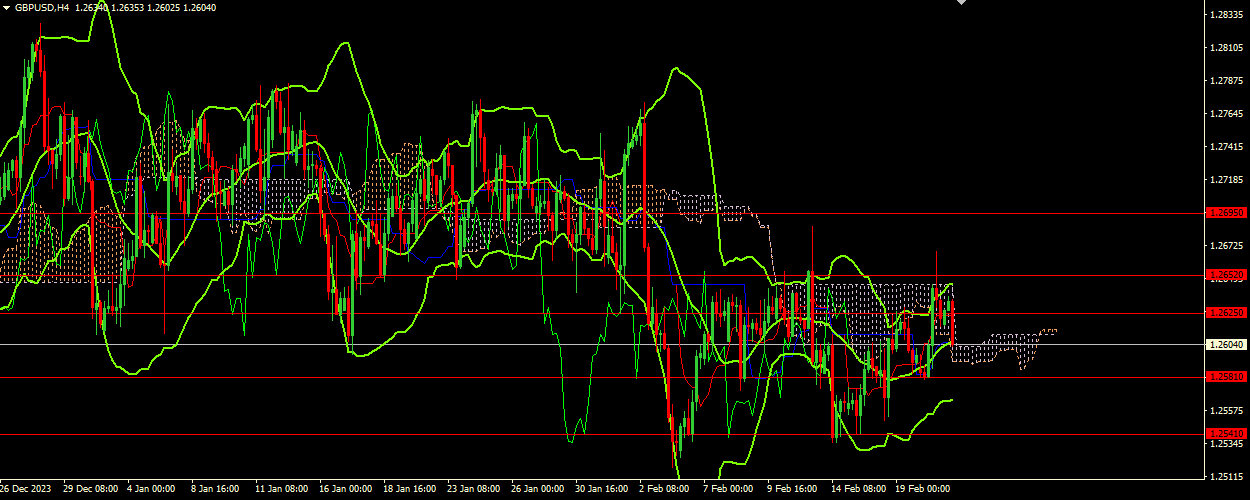

The technical analysis of GBP/USD, given the key levels and Bollinger Bands indicators presented, suggests a market scenario where we can expect volatility with potential for both upward and downward movements in the short term. The Bollinger Bands are pointing upwards, indicating that the trend may be leaning towards bullish sentiment in the short term. However, given that price is currently declining towards the middle band at 1.26060 and the current price is at 1.26050, there is a hint of consolidation or potential reversal from the recent upward movement. The wide price range between the upper and lower bands (1.26460 and 1.25660, respectively) suggests that there is still room for volatility. Price positioning near the middle band emphasizes a moment of equilibrium between buyers and sellers, but also indicates that the market may be preparing for the next significant move.

Main scenario (BUY)

Recommended entry level: 1.26250

Take Profit: 1.26520

Stop Loss: 1.26130

Alternative scenario (SELL)

Recommended entry level: 1.25810

Take Profit: 1.25410

Stop loss: 1.26000