Fundamental analysis USDJPY for 27.03.2024

The USD/JPY pair drifted lower for the third consecutive day, nearing its lowest level since November 2023 against the backdrop of a dovish stance from the Bank of Japan (BoJ) following its recent interest rate hike. Despite the BoJ's move, uncertainty persists regarding future policy steps, with the central bank refraining from providing clear guidance on the trajectory of policy normalization. Verbal interventions from Japanese authorities have served to stem further losses, but the JPY remains under pressure.

Additionally, consumer inflation expectations rose to 5.3% this month from 5.2% in February, potentially forcing the Federal Reserve to keep interest rates high for an extended period of time.

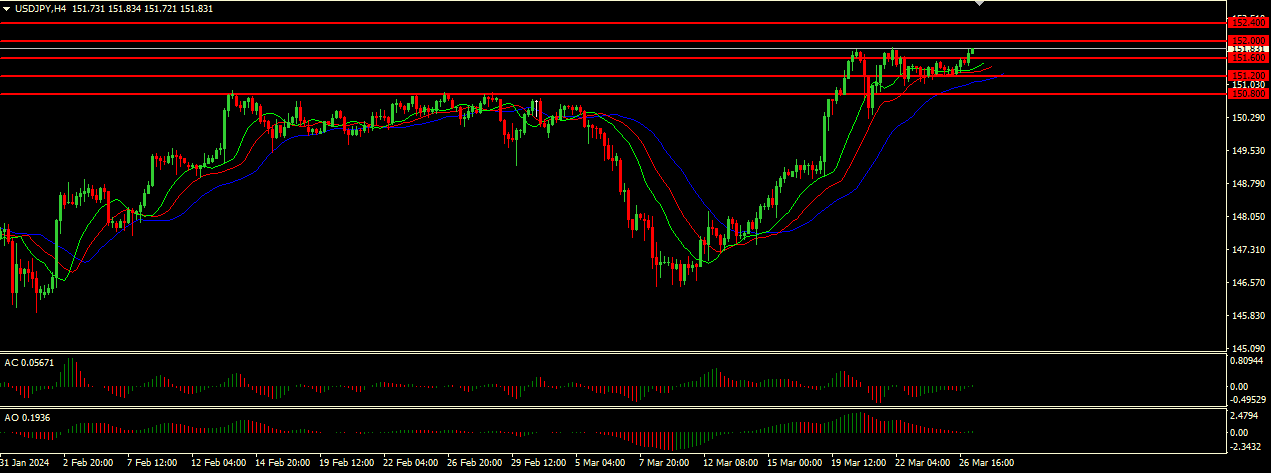

Given the current price of 151.831, the Alligator indicator suggests that the market is in an uptrend as its hungry mouth (blue line) is located below the lips and teeth (green and red lines). However, the Awesome Oscillator (AO) and Accelerator Oscillator (AC) in the green zone near the zero level indicate a strong buy signal, confirming the initial upside signal from the Alligator.

Main scenario (BUY)

Recommended entry level: 152.000

Take profit: 152.400

Stop loss: 151.600

Alternative scenario (SELL)

Recommended entry level: 151.600

Take profit: 151.200

Stop loss: 152.000