Fundamental analysis Gold for 26.04.2024

During the Asian session on Friday, the price of gold (XAU/USD) showed a modest increase, reaching $2,335 an ounce, although without sustained buying momentum and lingering below the previous high. Investors are redirecting their attention past the disappointing US GDP figures, as the growing consensus anticipates a delay in interest rate cuts by the Federal Reserve due to persistent inflationary pressures, consequently bolstering demand for the US Dollar (USD). This, coupled with a generally optimistic sentiment in equity markets, acts as a significant headwind for the safe-haven appeal of precious metals.

The latest US GDP report, revealing a notable slowdown in economic expansion and stubborn inflation, serves as a pivotal factor supporting the gold price. Data from the US Commerce Department discloses a mere 1.6% annualized growth rate for the largest global economy in the first quarter, marking the weakest performance since mid-2022. Furthermore, underlying inflation surpassed expectations, rising to 3.7% in the same period, reinforcing the expectation for the Federal Reserve to maintain higher interest rates for an extended period. The consequent surge in the yield of the 10-year US government bond, hitting its highest level in over five months, reacts to the mixed economic data, exerting downward pressure on the non-yielding yellow metal.

Additionally, diminishing concerns regarding further escalations in Middle Eastern geopolitical tensions dampen the appeal of gold as a safe-haven asset, further constraining its upward potential. Meanwhile, USD bulls remain cautious, awaiting clearer signals regarding the Federal Reserve's stance on interest rates, placing emphasis on the forthcoming release of the Personal Consumption Expenditures (PCE) Price Index. This critical inflation gauge will play a pivotal role in shaping the Fed's future policy decisions and steering demand for the USD, ultimately determining the short-term trajectory for the commodity.

Moreover, market sentiment regarding the trajectory of Federal Reserve interest rates significantly impacts the outlook for gold. Investors are now awaiting imminent data releases such as the core PCE Price Index, alongside personal income and spending figures, to gauge the economy's health and potential policy implications. Anticipated increases in personal income contrasted with expected decreases in personal spending add to the complexity of the market dynamics. Additionally, revisions to the University of Michigan Consumer Sentiment and Inflation Expectations figures are anticipated, providing further insight into consumer confidence and inflationary expectations.

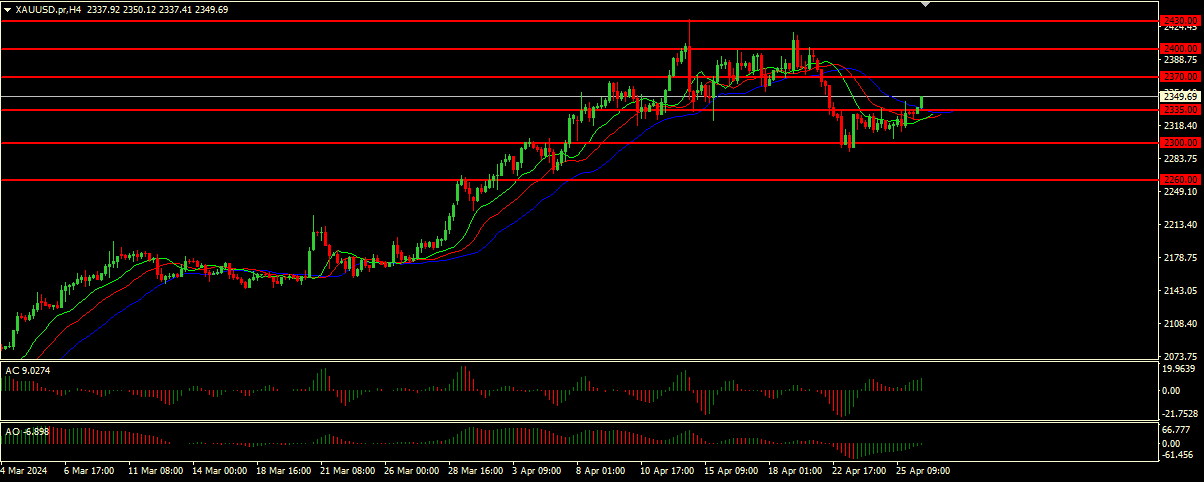

Technical analysis and scenarios:

The Alligator indicator is in a dormant state, which indicates a flat or consolidating market. However, both the Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the green zone, indicating potential upward momentum. If the market begins to reverse, as indicated by the exit of AO and AC from the green zone, and the price breaks below the key support level.

Main scenario (BUY)

Recommended entry level: 2350.00.

Take profit: 2370.00.

Stop loss: 2335.00.

Alternative scenario (SELL)

Recommended entry level: 2335.00.

Take profit: 2300.00.

Stop loss: 2370.00.