Fundamental analysis of WTI

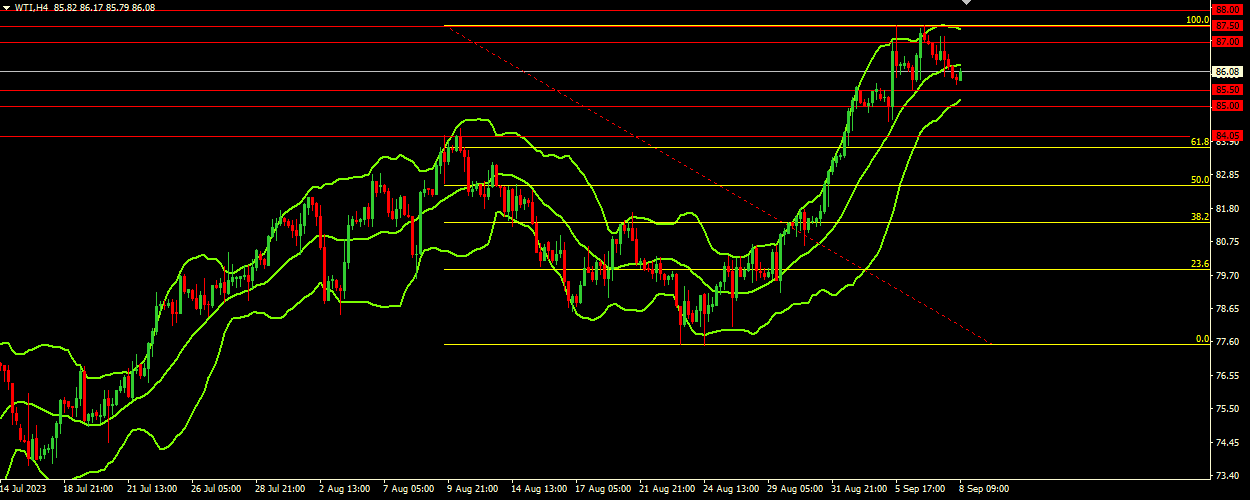

US benchmark WTI crude oil - currently trading around 86.10.

Oil prices are showing signs of a correction, especially as WTI crude has just bounced off an impressive 10-month high. Despite significant voluntary supply cuts from heavyweights such as Saudi Arabia and Russia, oil prices remained bearish. A strengthening US dollar and concerns over China's inconsistent economic recovery are the main potential factors dampening oil price gains.

As the world's largest oil importer, China plays an important role in determining global oil demand. Interestingly, despite concerns about the state of the economy, China still reported a 30.9% increase in crude oil imports last month. However, the data for August does not look as optimistic, showing a decline in exports and imports. This is likely due to macroeconomic concerns related to weak domestic consumer spending.

As for the US, the US Energy Information Administration hinted at a glimmer of hope for oil prices. Data from the Office showed that US crude oil inventories declined more than expected, falling by 6.37 million barrels in the first week of September. This trend has been observed for 4 consecutive weeks, indicating that US refineries are stepping up operations to meet global energy demand. These figures are much higher than the expected decline and are a potential counterbalance to the pressure the oil market is experiencing.

Another influencing factor is the recent strength in the US dollar, driven by a flurry of positive economic data. This strength, backed by reports such as the number of initial jobless claims in the US and rising labor costs, has boosted crude oil purchases. The U.S. dollar index is trading near 104.920, albeit down slightly from recent highs. A stronger dollar coupled with expectations that the US Federal Reserve will keep interest rates high and possibly raise them by 25 basis points in the coming months could be a challenge for WTI crude oil prices.

On the global geopolitical arena, the upcoming G20 Leaders Summit in New Delhi is expected to be held in the absence of Chinese President Xi Jinping, which may aggravate the already fragile relations between the US and China.

To summarize, while factors such as prolonged supply cuts and positive U.S. inventory data reinforce bullish sentiment on oil prices, a combination of economic, geopolitical and monetary factors suggest a cautiously bearish outlook for WTI in the near term. Global markets are waiting for clear signs of sustained demand before expressing further optimism.

Technical analysis and scenarios:

WTI is currently trading near the key level of $86.00 per barrel. Given the current price position relative to the Bollinger Bands and the support and resistance levels presented, we can determine the potential direction of the market in the coming days. The price is approaching the middle band, which is located at the level of 86.30. The Bollinger Bands are narrowing, which indicates a decrease in volatility and the possibility of a breakout in either direction.

Main scenario (SELL)

Recommended entry level: 86.00.

Take Profit: 85.00.

Stop loss: 86.50.

Alternative scenario (BUY)

Recommended entry level: 87.00.

Take Profit: 87.50.

Stop loss: 86.75.