Fundamental analysis of XAU/USD

XAU/USD prices declined on Tuesday, dropping to the 1910.50 support level mainly due to the strengthening US dollar, which recently hit its highest level in 2023, and rising US Treasury yields.

As the US dollar strengthens, a challenging environment is created for gold. This negative pressure is compounded by indications that the Federal Reserve may keep interest rates high for an extended period of time, with recent indications pointing to another rate adjustment in November or December this year. This development is driven by the Fed's concerns about the persistence of inflation in the US and a corresponding change in the country's policy outlook, which now expects fewer interest rate cuts in 2024 than expected. The move is supported by both recent strong macroeconomic data in the US and the views of influential Fed officials. For example, recent comments from Minneapolis FRB head Neel Kashkari suggest that interest rates may need to rise and hold to stabilize the U.S. economy.

At the same time, 10-year Treasury bond yields have risen to levels not seen since 2006, underscoring the strength of the dollar and further undermining gold's position in the market. This pressure on gold prices is widespread among investors due to concerns about a possible US government shutdown in October in case of a failure of budget negotiations and worries about the state of the Chinese real estate market. The situation is somewhat mitigated by the existing sense of risk aversion. While risk aversion, expressed in the form of waning enthusiasm for equities, is helping to reduce the attractiveness of gold as a safe haven, pessimism about its prospects remains popular. This outlook is likely to be influenced by key economic data and further policy decisions by the Federal Reserve in the coming months.

Investors are keeping a close eye on various economic indicators and the Fed's preferred inflation gauge, the Personal Consumption Expenditure Price Index, as well as upcoming data from the housing sector to gauge the economic trajectory.

Technical Analysis and Scenarios:

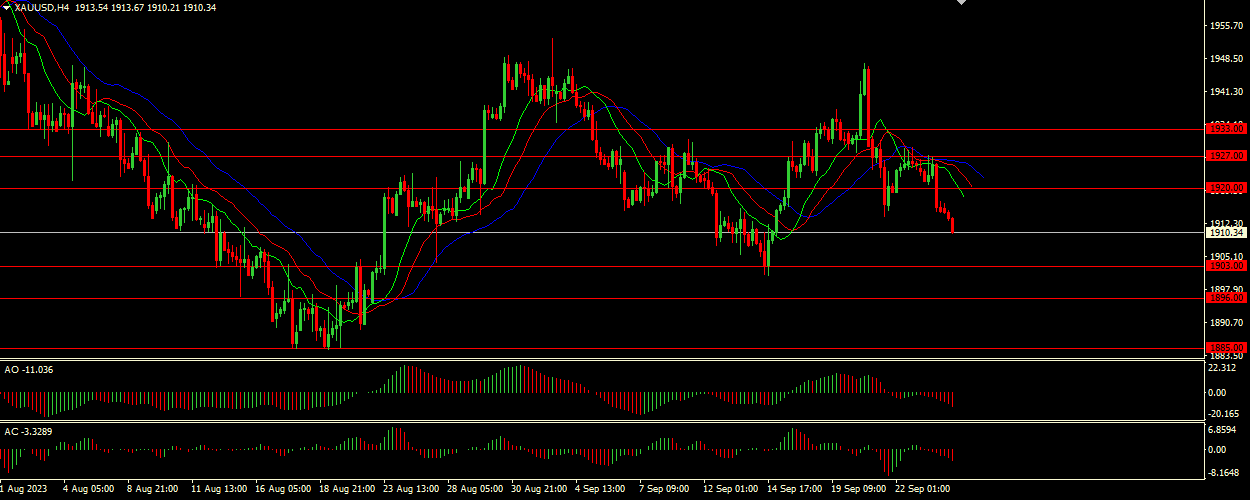

Given the current price of 1910.50 which is below the primary resistance levels and Alligator's indication that the instrument is in a downtrend, we can expect further bearish movement in the coming days.

Main scenario (SELL)

Recommended entry level : 1903.00.

Take Profit: 1896.00.

Stop loss: 1907.00.

Alternative scenario (BUY)

Recommended entry level: 1920.00.

Take profit: 1927.00.

Stop loss: 1917.00.