Fundamental analysis of XAU/USD

The value of gold (XAU/USD) has been trending lower of late, trading at 1897.10, and this decline has been exacerbated by the continued strength of the US dollar (USD) for the first time in 10 months.

The dollar's strong performance was in response to the Federal Reserve's warning that interest rates could remain high for an extended period. The move was driven by market expectations that the Fed would continue to raise interest rates, especially with inflation exceeding the Fed's 2% target. Inflation concerns were underscored by statements from officials such as Chicago Fed President Austan Goolsbee, who argued that inflation above a certain threshold posed a greater threat than monetary policy measures.

As the U.S. dollar strengthens, yields on 10-year U.S. Treasury bonds are also rising, reaching their highest level since 2007, attracting investment away from gold, which has been underperforming. In addition, despite unfavorable market conditions, gold's appeal as a traditional safe haven appears to be waning. Recent U.S. data, including a decline in consumer confidence, suggests that continued high inflation and rising interest rates are adding to consumer stress. In addition, concerns about a possible housing crisis in China, the world's largest economy, are influencing investors' preferences for assets considered riskier.

In the near future, the market will focus on a number of important reports, in particular, the US personal consumption expenditure index and other key reports on the labor market and CPI. These reports will provide a clearer picture of whether the US Federal Reserve will maintain its current policy stance or whether there will be room for adjustment. Given a combination of factors, including a strong dollar, important upcoming economic data and new interest rate scenarios, the overall market sentiment towards gold looks quite bearish. Investors should keep a close eye on the upcoming data releases as they have the potential to change market activity.

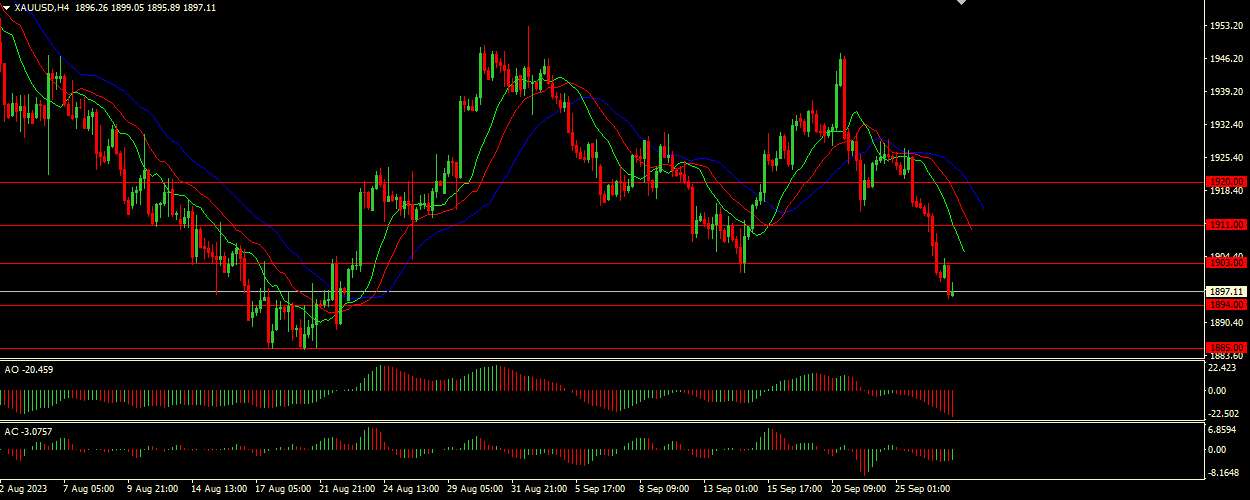

Technical Analysis and Scenarios:

Given the downtrend highlighted by the Alligator and the fact that price is currently near a key support level (1894.00), our main scenario sees the potential for the downtrend to continue. Technical indicators indicate that the XAU/USD (gold) pair is currently in a downtrend. While our main scenario recommends a sell position due to the Alligator alignment, traders should also be prepared for possible reversals, especially given the divergences exhibited by AO and AC.

Main scenario (SELL)

Recommended entry level : 1894.00.

Take Profit: 1885.00.

Stop loss : 1900.00.

Alternative scenario (BUY)

Recommended entry level: 1903.00.

Take profit: 1911.00.

Stop-loss: 1900.00.