Fundamental analysis of XAU/USD for 16.02.2024

The recent gold price dynamics reflects the complex interplay between economic indicators and market sentiment: the price moves in response to changes in the US economic indicators and Federal Reserve policy expectations.

After a strong break of the 2000.00 support level and a further decline to 1984.20, gold prices rose on the back of a sharp fall in US retail sales in January, the largest monthly decline since February 2023, and a drop in jobless claims, a sign that the labor market is strong, reflecting a robust economy. These factors, along with a weaker dollar and falling government bond yields, are making gold more attractive to international investors.

However, precious metal price movements are closely linked to changes in interest rate expectations. Current data suggest that inflationary pressures will continue until the Federal Reserve signals an interest rate adjustment, so the short-term outlook for gold remains strong. With the recent news of rising inflation, expectations are growing that the Fed will postpone a rate cut and possibly begin it in June.

However, hawkish comments from Atlanta Fed President Rafael Bostic, prompted by rising US Treasury yields, supported the dollar and reduced gold's gains. Market attention is now focused on the US economic plans, including key indicators and comments from FOMC members. These plans will affect the dynamics of the US dollar and will also affect the price of gold. Although gold prices are already in negative territory for the second day of the week, all eyes are on the release of the Federal Open Market Committee (FOMC) meeting minutes.

The short-term outlook for gold is bearish due to rising inflation concerns, a strong dollar and short-term volatility. Investors are advised to pay close attention to upcoming economic indicators such as the Producer Price Index and other information from Fed officials to determine the direction of the market.

Technical Analysis and Scenarios:

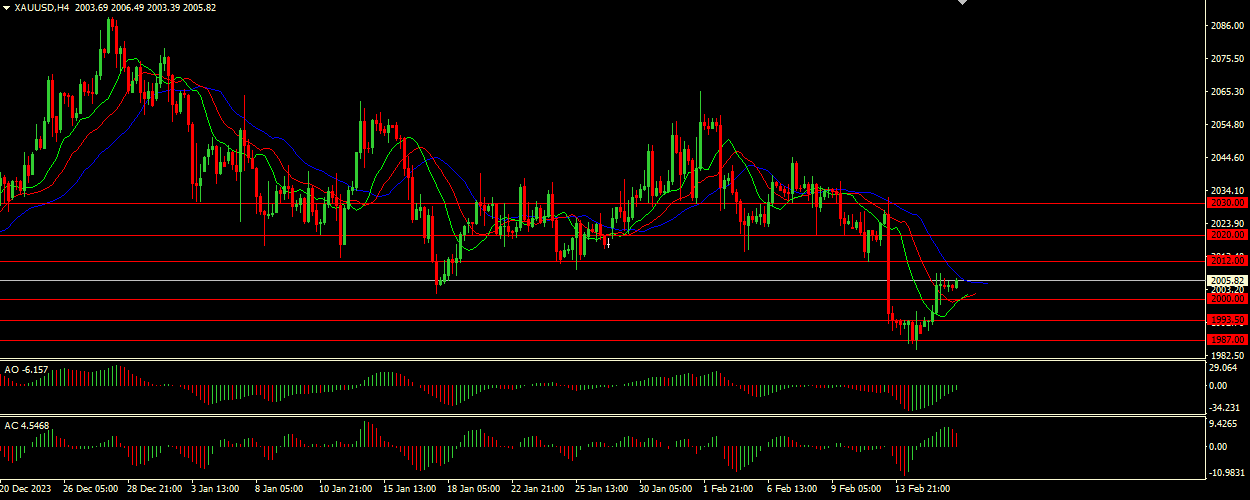

The alligator is sleeping, indicating that the market is in a consolidation phase with no clear trend direction. The intertwining moving averages indicate a period of low volatility and indecisive traders. Awesome Oscillator (AO) and Accelerator Oscillator (AC) are in the gray zone showing divergence. The lack of clear momentum and divergence suggests that traders should be cautious as there is no strong signal for market direction. Given the current price of 2005.80 and flat indicators, the main scenario suggests that XAU/USD will continue its range-bound movement between the nearest support and resistance levels.

Main scenario (BUY)

Recommended entry level: 2012.00

Take Profit: 2020.00

Stop Loss: 2008.00

Alternative scenario (SELL)

Recommended entry level: 2000.00

Take Profit: 1993.50

Stop loss: 2004.00