Fundamental analysis WTI for 26.02.2024

While the global oil market is under pressure and uncertainty, the price of WTI crude oil fell and reached 76.00.

The main reason for this fall is the increase in interest rates around the world, which limits economic activity and, in turn, reduces oil consumption and decreases demand. Federal Open Market Committee meeting minutes and hawkish comments from Fed officials point to concerns about continued inflationary pressures, lower short-term interest rates and the need to keep debt payments on hold. These ideas traditionally and naturally lead to lower oil prices.

In addition, geopolitical tensions, especially in the Middle East, may pose risks to oil stocks. However, no serious problems have emerged so far. Despite these geopolitical concerns, negotiators from the U.S., Egypt, Qatar and Israel reached an agreement on the hostage situation, signaling continued diplomatic efforts to ease tensions in the region.

Since November, oil prices have fluctuated between $70 and $90 per barrel due to a series of ups and downs. On the positive side, OPEC prices have been supported by geopolitical risks; on the negative side, concerns about weak demand, especially from China, have pressured the market. According to analysts, the geopolitical risk premium associated with the attacks on the merchant fleet in the Red Sea had a negligible impact on oil prices. Despite these concerns, Goldman Sachs raised its forecast for peak oil prices in the summer, citing tensions in the Red Sea that have further reduced oil inventories in OECD countries. The firm remains optimistic about global oil demand growth, although it has adjusted its forecasts for China, the U.S. and India to balance non-OPEC supply growth and strong global demand.

In short, the WTI crude oil market is operating in a complex environment characterized by a combination of monetary policy expectations, geopolitical tensions, demand and supply dynamics. While negotiations and geopolitics continue to evolve, markets remain focused on the changes that will impact the global economic outlook and oil demand.

Technical Analysis and Scenarios:

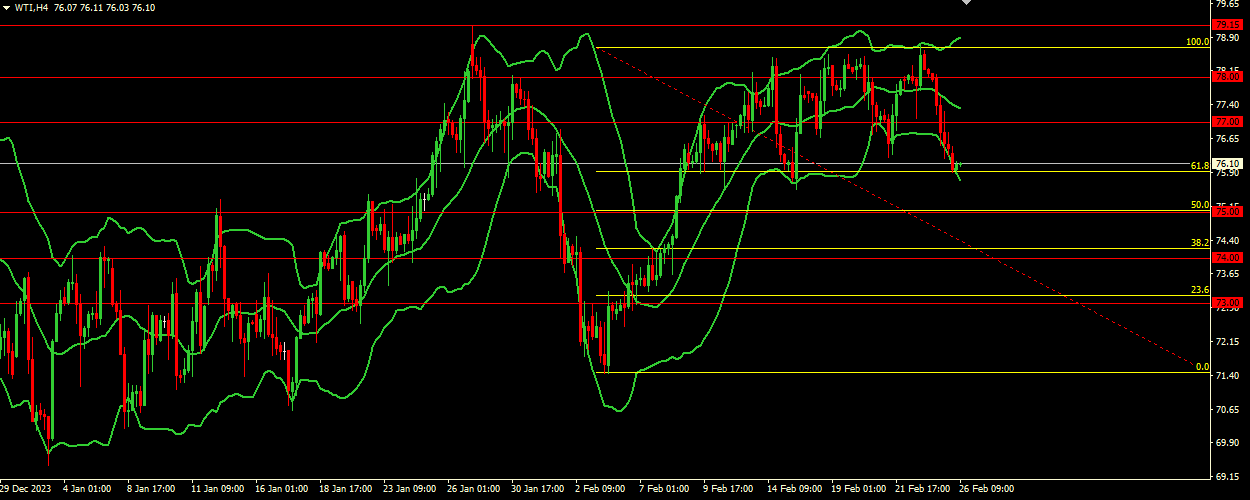

The current WTI price at 76.10 sits below the middle Bollinger Band of 77.30 and is rising in the lower range of the indicator, near the lower band of 75.72. This location suggests that the price is in a potential rebound phase from the lower boundary of the volatility range, indicating bearish or neutral sentiment in the short term. The Bollinger Bands are pointing downward as the price range expands, which usually signals increased market volatility and stronger bearish momentum. However, the current price proximity to the lower band may also indicate possible oversold conditions, leading to a potential short-term rebound or stabilization.

Main scenario (BUY)

Recommended entry level: 77.00

Take Profit: 78.00

Stop Loss: 76.50

Alternative scenario (SELL)

Recommended entry level: 75.00

Take Profit: 74.00

Stop loss: 75.50