Fundamental analysis of WTI

Oil prices began consolidating at 89.65 this week, reversing the previous Friday's decline, thanks in part to avoiding a U.S. government shutdown.

Prices for these benchmarks rose nearly 30% in the third quarter, helped by an expected supply shortage in the fourth quarter and prolonged supply cuts from countries such as Russia and Saudi Arabia. In particular, according to inside information, the OPEC+ group, which includes the Organization of the Petroleum Exporting Countries, Russia and its allies, is expected to stick to its current policy of cutting oil production. Despite global supply issues, U.S. oil production is nearing pre-pandemic highs. U.S. fossil fuel production is rising to fill the demand gap created by long-term production cuts by Saudi Arabia and Russia. Texas, the largest producer of shale oil, saw record production of 5.6 million barrels per day in July.

However, there are contrasts in demand. U.S. consumption of crude oil and other petroleum products fell to 20.12 million barrels per day in July, the lowest since April. Brent crude is expected to average around $89.85 a barrel in the fourth quarter, reflecting overall positive market sentiment on global supply concerns and stable U.S. production. Amid expectations that the US Federal Reserve (Fed) will raise interest rates, caution is spreading through the market. They are expected to be raised by 25 basis points later this year. Rising interest rates could increase borrowing costs and impact oil demand. U.S. oil inventories have recently declined, reinforcing bullish sentiment in the market. This decline contrasts with a report from the Energy Information Administration (EIA) that US crude oil production reached its highest level in years.

China's slowing economy is clouding the demand outlook, although the latest data shows a rise in China's manufacturing purchasing managers' index. The delicate balance between supply, production levels and inventories is reshaping the market. Given China's position as the world's largest oil importer, China's production data provides support for oil prices. Positive movement in the US Dollar Index (DXY) and US Treasury yields, coupled with recent weakness in US economic data, are posing challenges to crude oil positions. The upcoming release of US manufacturing data from ISM and Fed Chairman Jerome Powell's speech are expected events that could impact the future of the US Dollar and crude oil.

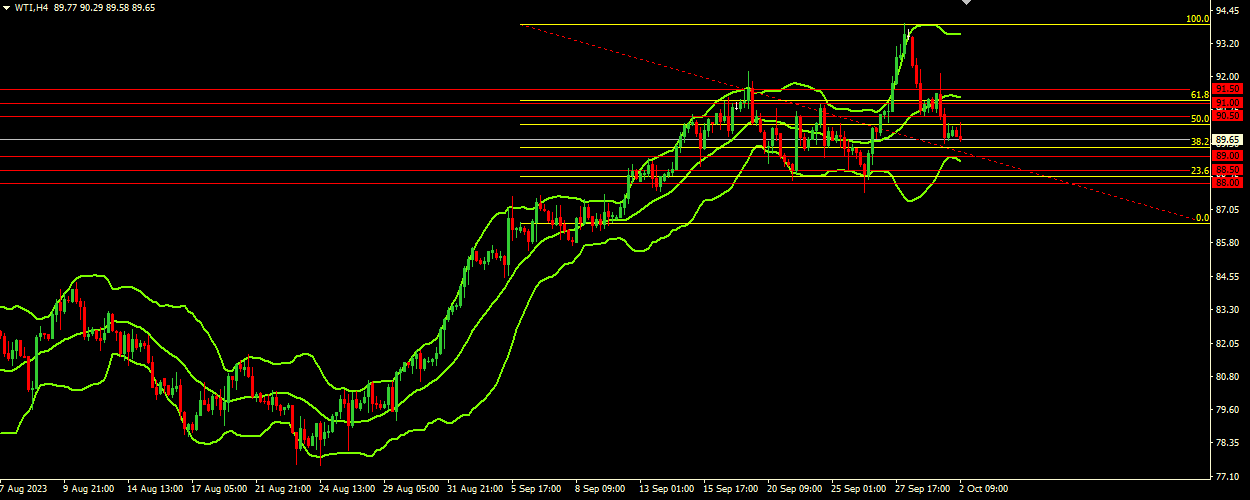

Technical Analysis and Scenarios:

The Bollinger Bands show that WTI crude oil is trading near the lower band. The upper band is at 93.60, the middle band is at 91.20 and the lower band is at 88.80. Currently, the bands are widening and price is trading in the lower band of the indicator, indicating potential downward pressure. Given the current position of the price, we can assume that it has more downside opportunities as it is trading near the lower Bollinger Band.

Main scenario (SELL)

Recommended entry level : 89.00.

Take Profit : 88.50.

Stop Loss: 89.25.

Alternative scenario (BUY)

Recommended entry level: 90.50.

Take Profit: 91.00.

Stop loss: 89.75.